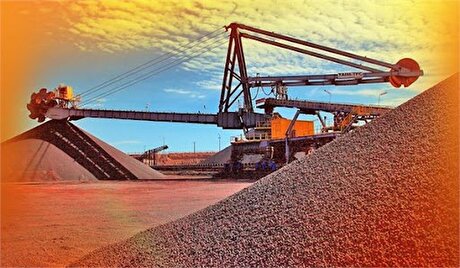

تلاش دولت برای توسعه معدن و محصولات معدنی در ۹۶

جعفر سرقینی با بیان اینکه بیانات رهبر انقلاب در مشهد وظیفه مسوولان بخش معدن را دو چندان کرد افزود: وظیفه مسوولان معدنی و معدنکاران در سال جدید این است که با مسوولیت بیشتری کارها را پیگیری کنند.

وی با اشاره به ارتباط غیر قابل انکار بخش معدن با صنعت ساختمان تصریح کرد: بر اساس آمار بانک مرکزی بخش ساختمان در سال 95 شاهد رشد منفی 18 درصدی بوده و با توجه به اینکه بیش از 70 درصد محصولات معدنی از نظر وزنی در صنعت ساختمان کاربرد دارد این رشد بر معادن نیز اثرگذار بوده اما با این وجود تلاش های زیادی برای توسعه بخش معدن و سودآوری این بخش صورت گرفته است.

سرقینی ادامه داد: در بخش معادن فلزی در سال گذشته اقدامات خوبی انجام شده که از جمله آن می توان به تکمیل زنجیره های ارزش افزوده در معادن فلزی و کانی های صنعتی اشاره کرد.

وی تاکید کرد: با تلاش های صورت گرفته در نه ماهه اول سال گذشته رشد بخش معدن به منفی 0.2 درصد رسیده که البته این آمار توسط بانک مرکزی بر اساس فعالیت 14 معدن اصلی کشور تهیه شده و تمام 6 هزار معدن فعال کشور در این آمار در نظر گرفته نشده و باید اصلاح شود.

به گفته معاون وزیر صنعت،معدن و تجارت چه این آمار اصلاح شود و چه نشود تلاش ها برای توسعه بخش معدن در سال جاری افزایش چشمگیری خواهد داشت.

سرقینی اظهار کرد: در 11 ماهه سال 95 بیش از یک میلیارد دلار مواد معدنی صادر شده که نسبت به مدت مشابه سال قبل 63 درصد افزایش وزنی و 50 درصد افزایش ارزشی داشته که این افزایش ناشی از سرمایه گذاری های هدفمند در تکمیل زنجیره های تولید ارزش افزوده بوده است.

این مقام مسوول یاداور شد: در 11 ماه سال گذشته 5 میلیارد دلار محصولات معدنی صادر شده که این آمار نیز 18 درصد افزایش از نظر ارزش را نشان می دهد.

وی با تاکید بر ضرورت تداوم تلاش ها برای توسعه معادن و افزایش ارزش افزوده این بخش اظهار امیدواری کرد با رشد صنعت ساختمان در کشور تولید معادن نیز ارتقا یابد.

سرقینی افزود: بدون توجه به رشد صنعت ساختمان نیز تلاش برای افزایش کیفیت و کمیت معادن و محصولات معدنی در دستور کار دولت برای سال 96 قرار دارد.

فلز کمیابی که خواب را از چشم بایدن گرفته است

بازدید فرماندار و مسوولین اجرایی شهرستان سقز از روند اجرای پروژه ملی احداث کارخانه استحصال طلای سقز

تحقق شعار سال ۱۴۰۳، نیازمند ایجاد شرکتهای پروژهمحور است

مجلس بر اجرای متناسبسازی حقوق بازنشستگان مطابق با برنامه اصرار دارد

افزایش ۹ درصدی تولید سالانه در منطقه ویژه اقتصادی خلیج فارس

ثبت سه محدوده معدنی جدید توسط شرکت اکتشاف و حفاری صدرتامین

"ومعادن" با رشدی ۳۳ درصدی بهای تمام شده سرمایهگذاریهای خود به استقبال سال جدید رفت

ثبت سومین رکورد تولید روزانه آهن اسفنجی در فولاد هرمزگان

افزایش تولید ۱۶ درصدی «گندله» و ۹ درصدی «کنسانتره» سنگ آهن شرکتهای بزرگ

کسری بودجه ترکیه ۱۶.۶ میلیارد دلار شد

مدیریت هوشمند مصرف آب و گاز با کنتورخوان از راه دور

ارزش بازار ارزهای دیجیتال کمتر شد

ادامه کاهش نرخ ارز در بازار

عملکرد بانک صادرات ایران در سال ۱۴۰۲ متفاوت و متمایز بوده است

محدودیت دامنه نوسان سهام تمدید شد

رکورد پشت رکورد/ "فخاس" بینظیر است!

جزئیات جلسه خودرویی وزیر صمت با شورای رقابت

جزئیات ارز پرداختی به واردات/ سهم کدام بخش بیشتر بود؟

فروش ۲۵۲ کیلو در حراج امروز+قیمت

تحقق شعار سال ۱۴۰۳، نیازمند ایجاد شرکتهای پروژهمحور است

دومین رکورد تناژ تولیدی تاریخ فولاد اکسین شکسته شد

قیمت جهانی طلا امروز ۱۴۰۳/۰۱/۲۴

آگهی فراخوان عمومی "طرح افزایش ایمنی و بهینهسازی تابلوهای موجود MV سایت کارخانه احیاء مستقیم شرکت جهان فولاد سیرجان" - شماره مناقصه: ۱۷-۰۳-ک-م

عملکرد بیسابقه فولاد آلیاژی ایران در سال ۱۴۰۲

مشکلی برای تأمین ارز نخواهیم داشت

افزایش ۹ درصدی تولید سالانه در منطقه ویژه اقتصادی خلیج فارس

مدیریت هوشمند مصرف آب و گاز با کنتورخوان از راه دور

ادامه کاهش نرخ ارز در بازار