رشد ۳ برابری سرمایهگذاری حملونقل ریلی

بسیاری از پروژههای ریلی که سالها در بخش پیشنهادها خاک میخوردند، پس از روی کار آمدن دولت یازدهم به مرحله اجرا و حتی افتتاح رسیدند. با این حال هنوز هم بسیاری از مناطق کشور هستند که به شبکه ریلی متصل نشدهاند. عباس آخوندی در مراسم بهرهبرداری از ۱۱۳ سالن مسافری درباره برخی از این دستاوردها توضیح داد.

وزیر راه و شهرسازی با اعلام اینکه اوضاع راهآهن در آیندهای نهچندان دور بسیار بهتر از شرایط فعلی خواهد بود، گفت: حدود ۲۰۰۰کیلومتر حجم پروژههای دوخطه و چند خطه کردن خطوط ریلی است و براساس برنامهریزی درنظر داریم ۵ استان کشور به شبکه ریلی متصل شوند.

وزیر راه و شهرسازی با تبریک سال نو به مردم ایران اظهار کرد: باید به گسترش حملونقل ریلی و رفاه بیشتر مردم امید داشته باشیم.

وی در ادامه خطاب به اظهارات عجولانه مدیرعامل رجاء، افزود: مدیرعامل رجاء با دیدن دو وزیر در مراسم روز گذشته با خود گفته که بهترین زمان برای گرفتن کمک از دولت است. در حالی که جیب ما خالی است و بهتر بود ایشان از منظر کارشناسی صحبت میکرد.

وی با بیان اینکه در حوزه حملونقل ریلی در ۳ سال گذشته اتفاقهای خوبی رخ داده است، گفت: مدیرعامل رجاء بهتر از هرکسی میداند که در سالهای اخیر حدود ۲هزار میلیارد تومان در حوزه حملونقل ریلی سرمایهگذاری شده است.

وزیر راه و شهرسازی تصریح کرد: این حجم از سرمایهگذاری در دولت یازدهم در حالی رخ داده که در سالهای پرپولی این کشور، حجم سرمایهگذاری در حملونقل ریلی شاید که به سالی هزار میلیارد تومان هم نمیرسید و این حجم سرمایهگذاری دولت در حوزه حملونقل ریلی بیانگر رشد ۳ برابری سرمایهگذاری حملونقل ریلی در مدت یک سال است.

آخوندی ادامه داد: حدود ۲ هزار کیلومتر حجم پروژههای دو خطه و چند خطه کردن خطوط ریلی است و براساس برنامهریزی دولت در نظر داریم ۵ استان کشور به شبکه ریلی متصل شوند.

وزیر راه و شهرسازی با اشاره به گزارش مدیرعامل شرکت ساخت و توسعه زیربناهای حملونقل درباره میزان پیشرفت طرح اتصال ۵ استان کشور به شبکه ریلی، گفت: براساس این گزارش به طور متوسط روزانه ۵/۳کیلومتر ریلگذاری انجام میشود.

این عضو کابینه دولت یازدهم افزود: اوضاع راهآهن در آیندهای نهچندان دور بسیار بهتر از شرایط فعلی خواهد بود.

وزیر راه و شهرسازی خطاب به حاضران در جلسه اظهار کرد: نرخ حق دسترسی بار از ۵۶ به ۳۰ درصد کاهش یافته است.

وزیر راه و شهرسازی با اشاره به اقدامات انجام شده در حوزه حملونقل حومهای افزود: حملونقل حومهای راهکار توسعه شهری و کمک جدی به کاهش آلودگی هوا به شمار میرود. از طرفی ما با تاکید بر شهرسازی ریلپایه استفاده از ایستگاههای راهآهن را به عنوان مراکز توسعه شهر قرار دادهایم.

آخوندی در ادامه به برنامه نوسازی ناوگان حملونقل ریلی اشاره کرد و گفت: در ۳ سال اخیر قطارهای بالای ۴۵ سال از ناوگان حملونقل ریلی کنار گذاشته شده است. در حالی که قطارهایی با عمر ۶۴ سال در ناوگان مورداستفاده قرار میگرفتند ما ۲۰ سال از عمر ناوگان را کنار گذاشتیم.

وزیر راه و شهرسازی با اشاره به حملونقل ریلی در برنامه ششم توسعه بیان کرد: برای ۶ هزار واگن باری و همچنین برای واگنهای مسافری در برنامه ششم توسعه برنامهریزی شده تا به سمت دستیابی به جایگاه حملونقل ریلی در بخش بار و مسافر حرکت کنیم.

وی با بیان اینکه در وزارت راه و شهرسازی حملونقل ریلی در اولویت و بالاتر از حوزه دریایی و جادهای قرار دارد از برنامهریزی روشن این وزارتخانه برای سرمایهگذاری ۲۸ هزار میلیاردی در حوزه حملونقل ریلی خبر داد.

آخوندی سرمایهگذاری و تامین ۱۱۳ واگن مسافری از سوی بخش غیردولتی را بیانگر امیدواری این بخش به آینده حملونقل ریلی دانست.

توسعه صنعت ریلی، تولید رقابتپذیر

علیم یارمحمدی، نایب رئیس اول کمیسیون عمران در مجلس شورای اسلامی با اشاره به اینکه دولت یازدهم در توسعه صنعت ریلی عملکرد قابلدفاعی دارد، گفت: بسیاری از مسیرهای پرتردد تا قبل از دولت یازدهم یک خطه بودند که خوشبختانه دو خطه کردن آنها در این دوره در دستور کار اصلی وزارت راه و شهرسازی بود که اکنون در حال اجراست.

وی با اشاره به اینکه بخش خصوصی در توسعه صنعت ریلی وارد این بخش از زیرساختهای کشور شد، افزود: تا قبل از دولت یازدهم شاهد این اتفاق نبودیم و بخش خصوصی تمایل چندانی به حضور در این پروژه نشان نمیداد. در ۳ سال گذشته با تغییر در ساختار قراردادهای توسعه صنعت ریلی این بخش در کشور حاضر شد به پروژههای زیرساختی مانند صنعت ریلی رو بیاورد و برای آن بتواند توجیه اقتصادی درنظر داشته باشد.

یارمحمدی خط راهآهن چابهار -زاهدان را یکی از اقدامات شایسته ریلی در کشور دانست و گفت: این پروژه اکنون تا ایرانشهر انجام شده و روند اجرای آن سرعت بسیار زیادی با خود همراه داشت که امیدواریم تا پایان سال ۹۷ به اتمام برسد. نایبرئیس کمیسیون عمران مجلس شواری اسلامی با اشاره به اینکه معادن یکی از مهمترین ظرفیتهای اقتصادی ایران است، گفت: با این حال به دلیل هزینههای حملونقل در برخی از استانها ظرفیت بهرهبرداری به حداقل رسیده و باید درنظر داشت که ارزانترین شیوه حملونقل مواد معدنی شیوه ریلی است. اکنون یکی از مهمترین پروژههایی که در حال اجرا قرار گرفته و میتواند در این زمینه نقش توسعهای داشته باشد، خط ریلی طبس است.

وی با تاکید بر اینکه نباید خطوط ریلی را به حملونقل مسافران خلاصه کرد، گفت: در کشوری مانند ایران که تبادلات استانی بسیار بالاست، هزینه حملونقل بر نرخ تمام شده تاثیر بسیاری دارد. بر این اساس باید درنظر داشت که توسعه صنعت ریلی بر کاهش نرخ تمام شده و رقابتی شدن محصولات تولیدی در ایران کمک بسیاری میکند.

راهآهن، شاخص توسعه

شهرام کوسهغراوی، عضو کمیسیون عمران در مجلس شورای اسلامی با اشاره به اینکه مناطق محروم و توسعهنیافته شرق گلستان نیازمند نگاه ویژه هستند، گفت: یکی از نیازهایی که در این زمینه وجود دارد توسعه صنعت ریلی در این منطقه از کشور است.

وی با بیان اینکه راهآهن گرگان - گنبدکاووس باید به راهآهن گرگان - کلاله تغییر کند، توضیح داد: این راهآهن از هر مسیری عبور کند به طور قطع از گنبدکاووس میگذرد. سالانه ۱۸ میلیون زائر حرم امام رضا (ع) از استان گلستان عبور میکنند و در فاصله مینودشت – کلاله، سهراهی گالیکش وجود دارد. به دلیل حجم بالای تردد، بسیاری از تصادفها در این منطقه اتفاق میافتد.

این عضو کمیسیون عمران با اشاره به اینکه مسیرسازی در توسع صنعت ریلی اهمیت زیادی دارد، گفت: راهآهن برای هر منطقه یکی از شاخصهای توسعه است و دولت با توجه به توانی که در این بخش دارد میتواند با درنظر گرفتن توجیه اقتصادی، این شاخص توسعه را در مناطق محروم ایجاد کند.

فلز کمیابی که خواب را از چشم بایدن گرفته است

بازدید فرماندار و مسوولین اجرایی شهرستان سقز از روند اجرای پروژه ملی احداث کارخانه استحصال طلای سقز

تحقق شعار سال ۱۴۰۳، نیازمند ایجاد شرکتهای پروژهمحور است

اطلاعیه فرابورس برای واگذاری استقلال و پرسپولیس

مجلس بر اجرای متناسبسازی حقوق بازنشستگان مطابق با برنامه اصرار دارد

ثبت سه محدوده معدنی جدید توسط شرکت اکتشاف و حفاری صدرتامین

مراسم معارفه مدیرعامل شرکت ملی صنایع مس ایران برگزار شد

آگهی فراخوان عمومی "طرح افزایش ایمنی و بهینهسازی تابلوهای موجود MV سایت کارخانه احیاء مستقیم شرکت جهان فولاد سیرجان" - شماره مناقصه: ۱۷-۰۳-ک-م

پیام مدیرعامل شرکت فولاد آلیاژی ایران به مناسبت عید سعید فطر

دستور رئیسجمهور برای اجرای نهضت نوسازی ماشینآلات صنعتی/ احیای ۸۴۰۰ واحد راکد در دولت سیزدهم

ثبت بالاترین میزان تاریخ تولید فولاد ایران در سال ۱۴۰۲

راهاندازی بلوک دوم نیروگاه سیکل ترکیبی قدس (شهید باکری) سمنان

اقتصاد ژاپن خوش رنگ شد

کدام کشور بالاترین نرخ تورم را ثبت کرد؟

مرحله سوم سود سهام عدالت در راه است

فعالیت در بورس چگونه به تولید کمک میکند؟

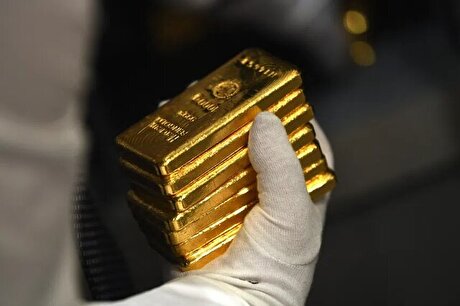

طلای جهانی دوباره از جا برخاست

درج شرکت آلیاژ گستر هامون در بازار دوم فرابورس ایران

حمایت از سرمایهگذاریهای قانونی در استخراج رمزارزها و آمادگی تامین برق

تحقق شعار سال ۱۴۰۳، نیازمند ایجاد شرکتهای پروژهمحور است

دومین رکورد تناژ تولیدی تاریخ فولاد اکسین شکسته شد

قیمت جهانی طلا امروز ۱۴۰۳/۰۱/۲۴

پیام مدیرعامل شرکت فولاد آلیاژی ایران به مناسبت عید سعید فطر

آگهی فراخوان عمومی "طرح افزایش ایمنی و بهینهسازی تابلوهای موجود MV سایت کارخانه احیاء مستقیم شرکت جهان فولاد سیرجان" - شماره مناقصه: ۱۷-۰۳-ک-م

دستور رئیسجمهور برای اجرای نهضت نوسازی ماشینآلات صنعتی/ احیای ۸۴۰۰ واحد راکد در دولت سیزدهم

ثبت بالاترین میزان تاریخ تولید فولاد ایران در سال ۱۴۰۲

راهاندازی بلوک دوم نیروگاه سیکل ترکیبی قدس (شهید باکری) سمنان

کدام کشور بالاترین نرخ تورم را ثبت کرد؟