سرویس خبر : معادن و مواد معدنی

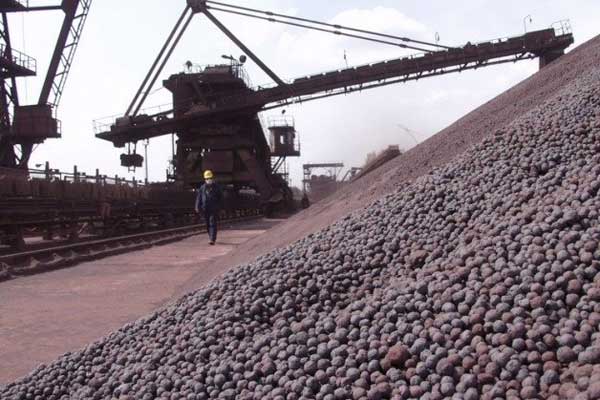

کاهش تولید و صادرات دومین تولید کننده سنگ آهن دنیا

می متالز - شرکت معدنی ریو تینتو که دومین تولید کننده بزرگ سنگ آهن دنیاست از کاهش تولید و فروش سنگ آهن خود در سه ماه نخست سال خبر داد که به دلیل شرایط بد آب و هوایی در استرالیا بود.

بین ژانویه تا مارس این شرکت 76.7 میلیون تن سنگ آهن صادر کرد که 13 درصد نسبت به سه ماهه چهارم سال 2016 افت داشت ولی نسبتا مشابه فصل اول سال گذشته بود. تولید 77.2 میلیون تن بود که 3 درصد نسبت به سال قبل و 10 درصد نسبت به فصل گذشته افت داشت که به دلیل اختلال در فعالیت این شرکت در زمان سیل و طوفان در استرالیا بود.

هدف تولید امسال این شرکت نیز تغییر نکرده 330 تا 340 میلیون تن اعلام شده است.

منبع: ایفنا

عناوین برگزیده

یک ساعت پیش

بیست و سه ساعت پیش

دو روز پیش

سه روز پیش

چهار روز پیش

در گفتگو با مدیرعامل نخستین شرکت پروژهمحور در ایران عنوان شد:

تحقق شعار سال ۱۴۰۳، نیازمند ایجاد شرکتهای پروژهمحور است

دستورالعمل تنظیم بازار ورق گرم فولادی بازبینی میشود

اطلاعیه فرابورس برای واگذاری استقلال و پرسپولیس

صالحی:

مجلس بر اجرای متناسبسازی حقوق بازنشستگان مطابق با برنامه اصرار دارد

با حضور رئیس هیات عامل ایمیدرو:

مراسم معارفه مدیرعامل شرکت ملی صنایع مس ایران برگزار شد

قیمت جهانی طلا امروز ۱۴۰۳/۰۱/۲۹

مدیرعامل شرکت سرمایهگذاری توسعه معادن و فلزات عنوان کرد:

افتتاح نخستین طرح پیشران اقتصادی با سرمایهگذاری "ومعادن"/ سرمایهگذاری ۳.۵ میلیارد دلاری "ومعادن"

دومین رکورد تناژ تولیدی تاریخ فولاد اکسین شکسته شد

کشف یک تن شیشه از بار ۲۰ تنی سنگ معدن تریلی توقیفی

بیانیه فولاد خوزستان در محکومیت دور جدید تحریمهای آمریکا علیه این شرکت/ فعالیت خود را با اقتدار و اثربخشی بیش از پیش ادامه میدهیم

سیاهکلی:

فاصله بین قیمت جهانی و بهای واقعی فولاد تولیدی به جیب دولت میرود

حاجی دلیگانی:

نوسانات ارز همه ابعاد اقتصادی زندگی مردم را تحت تاثیر قرار میدهد/ دولت جدی ورود کند

عباسپور:

نابسامانی بازار خودرو ناشی از بیتوجهی دولت به واردات است

سیاستمدار فرانسوی:

رهبران اروپا اقتصاد را نابود کردند

طرح اصلاح جریان مالی صنعت برق وارد مرحله اجرایی شد

اوپک میتواند مانع ۱۰۰ دلاری شدن قیمت نفت شود

قیمت جهانی طلا امروز ۱۴۰۳/۰۱/۳۱

سقوط قیمت بیتکوین تا زیر ۶۰ هزار دلار

اطلاعیه جدید بانک مرکزی درباره تخصیص ارز

افتتاح بزرگترین کارخانه فروسیلیس ایران در دامغان طی سفر دولت سیزدهم

ثبت بالاترین میزان تاریخ تولید فولاد ایران در سال ۱۴۰۲

کشف یک تن شیشه از بار ۲۰ تنی سنگ معدن تریلی توقیفی

تحقق شعار سال ۱۴۰۳، نیازمند ایجاد شرکتهای پروژهمحور است

دستورالعمل تنظیم بازار ورق گرم فولادی بازبینی میشود

دومین رکورد تناژ تولیدی تاریخ فولاد اکسین شکسته شد

اطلاعیه جدید بانک مرکزی درباره تخصیص ارز

چاپ ایران چک ۵۰۰ هزار تومانی تکذیب شد

حمایت ۲.۵۵۰ همتی صندوق تثبیت بازار سرمایه از بازار سهام در فروردین ۱۴۰۳