در صورت تحقق برنامه توسعه افزایش ظرفیت تولید آلومینیوم، مدیریت صحیح صنایع پاییندست آلومینیوم ضروری است

صنعت آلومینیوم کشور بهعنوان یکی از مهمترین صنایع معدنی و متالورژیکی کشور یکی از صنایع کلان محسوب میشود. بسیاری از صنایع معدنی با سهم تقریبی ۵ درصدی در تولید ناخالص داخلی کشور، در حال رشد و افزایش ظرفیت خود هستند. رشد در صنعت آلومینیوم علاوه بر اهمیت آن برای دیگر صنایع مصرفکننده داخلی، از نقطه نظر رقابتی در منطقه خاورمیانه حائز اهمیت است. در صنایع معدنی، کمتر صنعتی را همچون آلومینیوم میتوان نام برد که رقبای متعدد و بسیار قدرتمندی از آن در منطقه وجود داشته باشد. در منطقه خاورمیانه علاوه بر ایران، عربستان سعودی، امارات متحده عربی، بحرین، قطر و به تازگی کشور عمان از رقبای اصلی این صنعت بهشمار میروند. این در حالی است که ایران از پایهگذاران این صنعت در خاورمیانه بود ولی در حال حاضر با تولید تقریبا ۳۸۰ هزار تن آلومینیوم اولیه (آلومینیوم تولید شده از منابع معدنی) در جایگاه پنجم منطقه خاورمیانه قرار دارد.

منطقه خاورمیانه بهاتکای بهرهمندی از انرژی ارزانقیمت در کنار نیروی کار مساعد و ارزان، توانسته به یکی از مهمترین مناطق تولید آلومینیوم اولیه در جهان بدل شود. در همین راستا، بهمنظور حفظ جایگاه رقابتی ایران با دیگر کشورهای همسایه در صنعت آلومینیوم و همچنین افزایش تولید ناخالص داخلی کشور، ایران در نظر دارد تا با احداث واحدهای جدیدی از تولید آلومینیوم اولیه ظرفیت تولید آلومینیوم اولیه کشور را از حدود ۴۹۰ هزار تن به حدود ۱.۵ میلیون تن تا سال ۱۴۰۴ شمسی (۲۰۲۵ میلادی) افزایش دهد. بدین ترتیب بهطور متوسط سالانه افزایش ۱۳ درصدی ظرفیت تولید را باید انتظار داشت.

بهدنبال طرحریزیهای انجام شده در خصوص افزایش ظرفیت تولید آلومینیوم، واحدهای متعددی از بخشهای پاییندست این صنعت در کشور احداث شده و یا در حال احداث هستند. با توجه به این نکته که در حال حاضر با تولید تقریبا ۳۸۰ هزار تنی آلومینیوم و بازیافت کمتر از ۳۰ درصدی آلومینیوم در کشور، بسیاری از واحدهای کنونی پاییندست آلومینیوم با نرخ اندکی از ظرفیت تولید خود در حال بهرهبرداری هستند؛ این در حالی است که مجموع ظرفیت طرحهای ثبت شده در وزارت صنعت، معدن و تجارت حاکی از افزایش چندین برابری این ظرفیت تا بیش از ۵.۱ میلیون تن است. با توجه به نرخ رشد صنایع مصرفکننده و افزایش مصرف آلومینیوم در این صنایع، میتوان تقاضای آینده محصولات آلومینیومی را برای کشور تخمین زد. با در نظر داشتن نرخ بهرهبرداری کنونی از ظرفیتهای پاییندست آلومینیوم و افزایش چشمگیر ظرفیت تولید تا چند سال آینده، میتوان اذعان کرد که بسیاری از واحدها، همچنان با نرخ بسیار کمی (و چه بسا کمتر از نرخ کنونی) از ظرفیت خود بهرهوری داشته باشند. بدین ترتیب با در نظر گرفتن این عوامل، میتوان میزان عرضه و تقاضای آتی محصولات پاییندست آلومینیوم را تراز کرد.

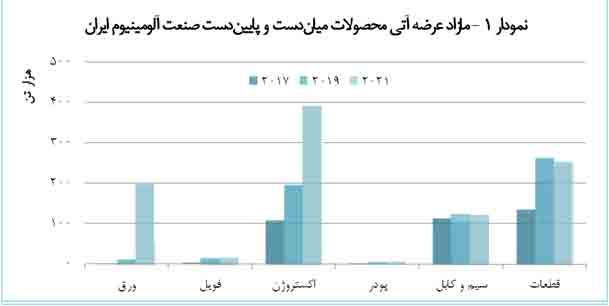

در همین راستا، نمودار ۱، مازاد عرضه محصولات داخلی را برای انواع واحدهای میاندست و پاییندست صنعت آلومینیوم کشور نشان میدهد (بخشی از ورقهای آلومینیومی مستقیما در محصول نهایی استفاده میشوند که در این تقسیمبندی در نمودار نشان داده شدهاند). با توجه به دادههای نمودار ۱، مازاد عرضه برای محصولات اکستروژن آلومینیوم افزایش چشمگیری خواهد یافت بهطوری که از حدود ۱۰۰ هزار تن در سال ۲۰۱۷ به حدود ۴۰۰ هزار تن در سال ۲۰۱۹ خواهد رسید.

در بین محصولات نشان داده شده در نمودار ۱، فویلهای آلومینیومی و پودر کمترین میزان مازاد عرضه را دارا هستند که با توجه به ظرفیتهای این محصولات میتوان گفت که مازاد عرضه فویل آلومینیومی و پودر آن به ترتیب در حدود ۲۸ و ۶۰ درصد از تولید پیشبینی شده را دارا هستند. از همین رو میتوان گفت که فویلهای آلومینیومی تولید شده در آینده از وضعیت بهتری نسبت به سایر محصولات پاییندست آلومینیوم برخوردار خواهند بود. موضوع مازاد عرضه در عین نرخ بهرهوری پایین که معضلی در این صنعت محسوب میشود، با مدیریت صحیح و ایجاد شرایط لازم برای مصرف این محصولات در بازارهای بینالمللی میتواند به نقطه قوتی برای اقتصاد و صنعت کشور تبدیل شود.

افتتاح نخستین طرح پیشران اقتصادی با سرمایهگذاری "ومعادن"/ سرمایهگذاری ۳.۵ میلیارد دلاری "ومعادن"

افتتاح بزرگترین کارخانه فروسیلیس ایران در دامغان طی سفر دولت سیزدهم

طلای جهانی از تکاپو افتاد

بازار طلای جهانی اندکی سرد شد

درج شرکت آلیاژ گستر هامون در بازار دوم فرابورس ایران

تغییرات مدیریتی با تمرکز بر اهداف فنی و توسعهای/ فسادستیزی اساس کار در ایمیدرو است

ارزش سهام شرکت فولاد اقلید ۴ برابر شد

صنعت فولاد ایران هدف جدیدترین تحریمهای آمریکا

ساخت ابر پروژه فولاد استان همدان با ۳۰ هزار میلیارد ریال سرمایهگذاری

افزایش قابل توجه صادرات مواد معدنی ترکیه پس از اقدامات انجمن صادرکنندگان مواد معدنی دریای اژه

محرک جدید بورس

نبض مسکن تبریز شبیه اصفهان یا مشهد؟

گزارش عملیات اجرایی سیاست پولی

مسکن پس از ماه سرگیجه/ ۶ رویداد در معاملات مسکن تهران طی اولین ماه ۱۴۰۳ رخ داد

واحدهای تولید فولاد در هرمزگان ۳۰ درصد پیشرفت فیزیکی داشتهاند

اعضای هیات مدیره انجمن هوش مصنوعی ایران انتخاب شدند

تجارت در کانال مانش

عاقبت پروژههای روی زمین مانده تجارت

افزایش ۱۷ برابری خرید شمش در حراج مرکز مبادله

«تجلی» همچنان بر مدار توسعه/ آخرین خبرها از اولین شرکت پروژهمحور بورس

وزیر صمت: شورای رقابت مسوول قیمت پژوپارس است

طلای جهانی از تکاپو افتاد

جزئیات پیشرفت پروژه عظیم مجتمع مس جانجا اعلام شد

افتتاح نخستین طرح پیشران اقتصادی کشور با سرمایهگذاری «ومعادن»

ضرورت جذب سرمایهگذاری مالی و مشارکت مردمی برای توسعه معادن

افتتاح بزرگترین کارخانه فروسیلیس ایران در دامغان طی سفر دولت سیزدهم

ثبت بالاترین میزان تاریخ تولید فولاد ایران در سال ۱۴۰۲

افزایش قابل توجه صادرات مواد معدنی ترکیه پس از اقدامات انجمن صادرکنندگان مواد معدنی دریای اژه