افتتاح و آغاز عملیات اجرایی دو پروژه صنعتی و تولیدی

شرکت پارس فولاد جم سما( دانیلی) در زمینی به مساحت 140 هزار متر مربع در شهرک صنعتی اشتهارد بنا گردیده که 35000 متر مربع به کارخانه تولید و مونتاژ محصولات و 2 هزار متر مربع نیز به ساختمان فنی و اداری تخصیص یافته است.

هدف از این سرمایه گزاری بهبود توان رقابتی تولید کنندگان ایرانی در زمینه محصولات فولادی و فلزات غیرآهنی از طریق ارائه خدمات بهینه و تولید کالاهای داخلی مطابق با کیفیت جهانی گروه دنیلی می باشد.

محصولات اصلی این شرکت تولید کوره ذوب القایی با ظرفیت سالانه 2 دستگاه ، کوره ذوب قوس الکتریکی با ظرفیت سالانه 2 دستگاه ، کوره پخت آهک با ظرفیت سالانه یک دستگاه ، کوره عملیات حرارتی خلا با ظرفیت سالانه 2 دستگاه و کوره عملیات حرارتی معمولی با ظرفیت سالانه 2 دستگاه ذکر شده است.

لازم به ذکر است شرکت دنیلی ایتالیا یکی از شرکت های تولید قطعات و ماشین آلات کارخانجات قطعات فولادی است و در برخی کارخانه های فولادسازی در کشور توانسته دربخش فنی و ساخت ماشین آلات فعالیت کند.

گفتنی است: این شرکت ایتالیایی تا کنون حدود 16 کارخانه فولادسازی در قاره آسیا راه اندازی کرده که با توجه به نزدیکی شهرک صنعتی اشتهارد به فرودگاه بین المللی و باربری پیام کرج، این شهرک را برای احداث کارخانه قطعات فولادی مناسب دانسته است.

همچنین در این سفر یک روزه به استان البرز ، مهندس نعمت زاده کلنگ آغاز عملیات اجرایی شهرک نجم اباد را به زمین می زند

افتتاح نخستین طرح پیشران اقتصادی با سرمایهگذاری "ومعادن"/ سرمایهگذاری ۳.۵ میلیارد دلاری "ومعادن"

اطلاعیه فرابورس برای واگذاری استقلال و پرسپولیس

قیمت جهانی طلا امروز ۱۴۰۳/۰۱/۲۹

افتتاح بزرگترین کارخانه فروسیلیس ایران در دامغان طی سفر دولت سیزدهم

«فصبا» ۷۰ تومان سود تقسیم کرد

کشف یک تن شیشه از بار ۲۰ تنی سنگ معدن تریلی توقیفی

بازار طلای جهانی اندکی سرد شد

صبا فولاد خلیج فارس «فصبا» ۷۰ تومان سود تقسیم کرد/ پروژه احیای مستقیم «فصبا» سال ۱۴۰۵ به بهرهبرداری میرسد

درج شرکت آلیاژ گستر هامون در بازار دوم فرابورس ایران

نگاهی به معاملات امروز بورس کالا

عرضه ۲۴۰ هزار تن محصول در تالار صادراتی بورس کالا

نفت تغییر جهت داد

آخرین وضعیت بازار رمزارزها در جهان

جورچین صنعت گاز برای ادامه مسیر پرافتخار گاز ایران

رکورد تولید ماهانه صبا فولاد خلیج فارس شکسته شد

آگهیهای مسکن در دو پلتفرم «شیپور» و «دیوار» حذف میشود؟

چه تعداد عرضه اولیه، امسال در دستورکار سازمان بورس است؟

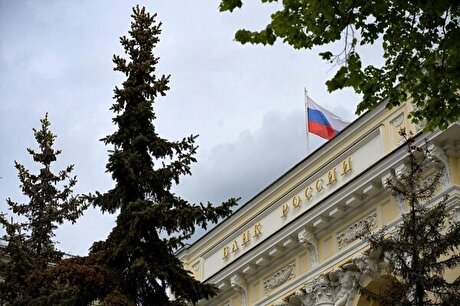

کارتهای بانکی اعتباری روسی در راه ایران

تسلا باز هم قیمت خودروهایش را کاهش داد

وزیر صمت: شورای رقابت مسوول قیمت پژوپارس است

افتتاح نخستین طرح پیشران اقتصادی کشور با سرمایهگذاری «ومعادن»

ضرورت جذب سرمایهگذاری مالی و مشارکت مردمی برای توسعه معادن

افتتاح بزرگترین کارخانه فروسیلیس ایران در دامغان طی سفر دولت سیزدهم

ثبت بالاترین میزان تاریخ تولید فولاد ایران در سال ۱۴۰۲

کشف یک تن شیشه از بار ۲۰ تنی سنگ معدن تریلی توقیفی

جورچین صنعت گاز برای ادامه مسیر پرافتخار گاز ایران

رکورد تولید ماهانه صبا فولاد خلیج فارس شکسته شد

آگهیهای مسکن در دو پلتفرم «شیپور» و «دیوار» حذف میشود؟