آلومینیوم زنگ خطری برای بازار مس

این در حالی است که تقاضای مس با توجه به لزوم استفاده از آن در برخی مصارف و بازارهای جدید مصرف، همچنان در حال رشد است.

در آغاز قرن حاضر، دیدگاه اکثر سرمایهگذاران صنعت فلزات این بود که آلومینیوم بهعنوان فلز قرن بیست و یکم شناخته خواهد شد. هماکنون میتوان صحت این ادعا را دید؛ چرا که تاکنون آلومینیوم بهطور گستردهای در صنعت خودروسازی و تا حدی در صنعت هوا- فضا مورد استفاده قرار گرفته است. دلیل دیگری بر این مدعا، توسعه مداوم و سریع شهرنشینی چین است که مصرف گسترده این فلز را بههمراه دارد. این کشور یکی بزرگترین مصرفکنندگان در صنعت فلزات در جهان بهشمار میرود. از این رو، با توجه به گسترش شهرنشینی که با سرعت قابل ملاحظهای در این کشور در حال افزایش است انتظار میرود که چین مصرفکننده کل مازاد عرضه آلومینیوم در بازار جهانی شود. شاید بتوان ادعا کرد که بنابر این پیشبینیها، برخی سرمایهگذاریهای عظیم در زمینه تولید اولیه آلومینیوم به مرحله اجرا رسیده و برخی دیگر در دست اقدام باشد.

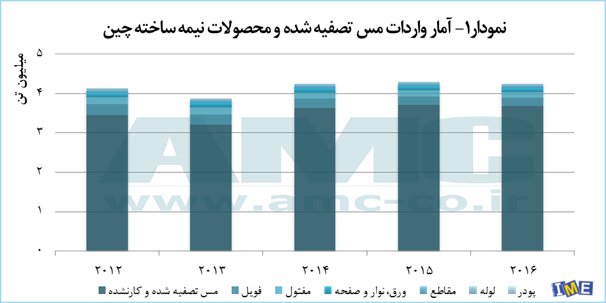

با این وجود، در طول دهه اخیر گسترش سریع شهرنشینی و توسعه شبکه برق در چین باعث افزایش تقاضا و قیمت مس نیز شده است. چین، مصرفکننده حدود نیمی از مس تولید شده در جهان است. از این رو، طی ۵ سال گذشته، بهطور متوسط چین واردکننده سالانه بیش از ۴ میلیون تن مس تصفیه شده و محصولات نیمهساخته آن بوده است. نمودار ۱، میزان واردات مس تصفیه شده و محصولات نیمهساخته مسی چین را از سال ۲۰۱۲ تا ۲۰۱۶ نشان میدهد. همانطور که در این نمودار مشاهده میشود واردات مس تصفیه شده و کارنشده بیشترین حجم از واردات مس به چین را تشکیل دادند

طبق برآوردهای انجام شده، مبلغی حدود ۴۵ میلیارد دلار در شبکه توزیع برق چین در سال ۲۰۱۶، سرمایهگذاری شد و همچنین مطابق برنامههای توسعه این کشور، بودجهای به میزان ۳۰۰ میلیارد دلار برای گسترش شهرنشینی تا سال ۲۰۲۰ در چین در نظر گرفته شده است. علیرغم حجم قابل ملاحظه برنامههای توسعهای در این کشور، فرآیند جایگزینی مس که در ۱۲ سال گذشته به حدود ۵ میلیون تن رسید بخش قابل توجهی از آن متعلق به آلومینیوم بوده است.

به عنوان مثال، مدتی است که کابلهای مسی در شبکه انتقال برق چین، رقابت را به کابلهای سبکتر و ارزانتر آلومینیومی باختهاند. با این وجود، فرصت برای بازار مس همچنان باقی است؛ چرا که با رشد شهرنشینی و رشد صنعت ساختمان در چین، تقاضا برای تجهیزات سرمایشی- گرمایشی و تهویه مطبوع، لوازم خانه و آشپزخانه و تجهیزات الکترونیکی همچنان پابرجا باقی خواهد ماند که مس در این صنایع، با توجه به استانداردهای بهینهسازی مصرف انرژی و افزایش بازدهی دستگاهها، حرف اول را میزند.

با توجه به اینکه کاهش هزینهها یکی از مهمترین عوامل در تصمیمگیریهای کلان بهحساب میآید؛ روند قیمتی مس از ابتدای قرن حاضر، مسیر مصرف مس در بسیاری از صنایع را به سمت جایگزینی با سایر مواد سوق داده اما باعث کاهش تقاضای مس نشده است. آلومینیوم بهعنوان یکی از بهترین جایگزینهای مس در قرن حاضر، قیمت بسیار کمتری در مقایسه با مس دارد. در نتیجه این عامل اساسی و سایر عوامل دیگر که عمدتا به کاربردپذیری آلومینیوم در جایگاه مس باز میگردد؛ در نیمی از جایگزینیهایی که تاکنون انجام شده، از آلومینیوم استفاده شده است. گرچه جایگزینیهای انجام شده تاکنون از نرخ رشد تقاضای مس کاسته، اما لزوم استفاده از مس در بسیاری از کاربردها و ایجاد بازارهای جدید مصرف، باعث شده تا از میزان تقاضای این فلز سرخ کم نشود

طلای جهانی از تکاپو افتاد

بازار طلای جهانی اندکی سرد شد

ارزش سهام شرکت فولاد اقلید ۴ برابر شد

صنعت فولاد ایران هدف جدیدترین تحریمهای آمریکا

ساخت ابر پروژه فولاد استان همدان با ۳۰ هزار میلیارد ریال سرمایهگذاری

جزئیات پیشرفت پروژه عظیم مجتمع مس جانجا اعلام شد

«تجلی» همچنان بر مدار توسعه/ آخرین خبرها از اولین شرکت پروژهمحور بورس

انعقاد قرارداد همکاری مشترک هلدینگ تجلی با دانشگاه شهید بهشتی

تعدیل نیرو در کارخانه فروآلیاژ ازنا ناشی از افزایش تعرفه برق است

پورمختار: مراکز پژوهشی، راهکارهای عملی برای مشارکت مردم در جهش تولید ارائه کنند

افتتاح همزمان ۱۶ نیروگاه خورشیدی در ۶ استان کشور

ضرورت روزآمدسازی دانش و اطلاعات مدیران مناطق نفتخیز جنوب

مدیر شرایط اضطراری و بحران پتروشیمیهای منطقه ویژه پارس منصوب شد

کنترل و پایش خطوط تولید با نرمافزارهای بومی مبتنی بر هوش مصنوعی

خوشبینی پاکستان درباره تکمیل خط لوله گاز با ایران بهرغم هشدار آمریکا

باید ساختمانهای باشکوه در ایران ساخته شود

بهبود پایداری شبکه برق فوق توزیع منطقه دشت آزادگان

فروش اطلس، کوییک، شاهین، سهند و ساینا به قیمت کارخانه

شعار امسال با انسجام جامعه کارگری محقق خواهد شد

«تجلی» همچنان بر مدار توسعه/ آخرین خبرها از اولین شرکت پروژهمحور بورس

وزیر صمت: شورای رقابت مسوول قیمت پژوپارس است

افزایش قابل توجه صادرات مواد معدنی ترکیه پس از اقدامات انجمن صادرکنندگان مواد معدنی دریای اژه

شتابدهندههای قیمت طلای جهانی کداماند؟/ اثر عوامل سیاسی و اقتصادی بر رشد فلز زرد

طلای جهانی از تکاپو افتاد

جزئیات پیشرفت پروژه عظیم مجتمع مس جانجا اعلام شد

افتتاح نخستین طرح پیشران اقتصادی کشور با سرمایهگذاری «ومعادن»

ضرورت جذب سرمایهگذاری مالی و مشارکت مردمی برای توسعه معادن

پورمختار: مراکز پژوهشی، راهکارهای عملی برای مشارکت مردم در جهش تولید ارائه کنند