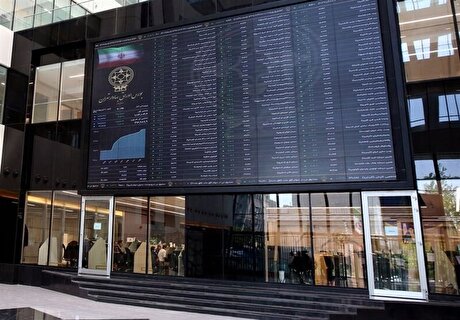

لزوم افزایش عرضه PPنساجی و شیمیایی

عرضه محصولات ۱۹ هزار و ۴۱۱ تن و تقاضای آن هم بالغ بر ۴۹ هزار و ۴۵۲ تن بود.

به این ترتیب همچنان پلی پروپیلن های نساجی و شیمیایی در گروه پلیمری ها مورد توجه خریداران بودند، به طوری که اکثر گریدهای عرضه شده مورد رقابت قرار گرفتند.

پلی پروپیلن نساجی SF۰۶۰ پلی نار با عرضه ۱۰۰۸ تن ۱۷۹۰ تن تقاضا داشت،قیمت پایه این کالا ۳ هزار و ۸۷۴ تومان و میانگین نرخ خرید آن هم ۴ هزار و ۴۲ تومان رقم خورد.

پلی پروپیلن نساجی ZH۵۵۰J نویدزرشیمی هم با حجم عرضه ۲۵۲ تن به میزان ۷۱۴ تن تقاضا داشت، میانگین نرخ خرید این کالا ۴ هزارتومان بود.

پلی پروپیلن شیمیایی ZR۲۳۰C نویدزرشیمی با ۷۵۶ تن عرضه ۲۵۸۵۱ تن تقاضا داشت، قیمت پایه این کالا ۴ هزار و ۳۷۹ تومان و نرخ خرید آن هم ۴ هزار و ۸۱۷ تومان رقم خورد.

پلی پروپیلن نساجی C۳۰S پتروشیمی مارون با ۳۳۰۰ تن عرضه ۴۸۶۲ تن تقاضا داشت، این کالا با میانگین نرخ ۳ هزارو ۹۶۹ تومان داد و ستد شد.

پلی پروپیلن نساجی Z۳۰S این مجتمع هم ۲۵۳۰ تن عرضه و ۳۲۱۲ تن تقاضا داشت و با میانگین نرخ ۳ هزار و ۹۳۲ تومان خریداری شد. پلی پروپیلن نساجی Z۳۰S پتروشیمی شازند با ۲۰۰ تن عرضه ۴۲۰ تن تقاضا داشت، این کالا با میانگین نرخ ۴ هزارو ۷ تومان خریداری شد.

همچنین درگروه پلی اتیلن ها، پلی اتیلن سنگین اکستروژن EX۳ هم ۱۵۰۰ تن عرضه و ۲۸۰۰ تن تقاضا داشت، قیمت پایه این کالا ۴ هزار و ۱۵۳ تومان و میانگین نرخ خرید آن هم ۴ هزارو ۲۵۹ تومان بود.

در همین حال پلی اتیلن سنگین دورانی ۳۸۴۰UA پتروشیمی شازند، پلی اتیلن سنگین فیلم HF۵۱۱۰ پتروشیمی نویدزرشیمی و پلی اتیلن سبک فیلم ۰۱۹۰ پلیمر آریاساسول وارد سیستم مچینگ شدند.

تحقق شعار سال ۱۴۰۳، نیازمند ایجاد شرکتهای پروژهمحور است

دستورالعمل تنظیم بازار ورق گرم فولادی بازبینی میشود

اطلاعیه فرابورس برای واگذاری استقلال و پرسپولیس

مجلس بر اجرای متناسبسازی حقوق بازنشستگان مطابق با برنامه اصرار دارد

افتتاح نخستین طرح پیشران اقتصادی با سرمایهگذاری "ومعادن"/ سرمایهگذاری ۳.۵ میلیارد دلاری "ومعادن"

مراسم معارفه مدیرعامل شرکت ملی صنایع مس ایران برگزار شد

قیمت جهانی طلا امروز ۱۴۰۳/۰۱/۲۹

دومین رکورد تناژ تولیدی تاریخ فولاد اکسین شکسته شد

کشف یک تن شیشه از بار ۲۰ تنی سنگ معدن تریلی توقیفی

شرکت صبا فولاد خلیج فارس، بزرگترین عرضهکننده آهن اسفنجی (قسمت اول)

جولان آیفون مستعمل/ گمرک و ستاد مبارزه با قاچاق شفافسازی کنند

آرامشدن بازار ارز و طلا از امروز با فروکش تنشهای سیاسی

وصل برق تمامی مناطق سیلزده به جز ۵ روستای صعبالعبور

سهمیه بنزین اردیبهشتماه بدون تغییر در کارتهای سوخت شارژ شد

بازگشت دامنه نوسان نمادهای معاملاتی به روال عادی، از امروز

حجم مبنای ۳ نماد در فرابورس برداشته شد

ضرورت بهبود عملکرد تعاونیها برای مشارکت تولید

حمایت ۲.۵ همتی صندوق تثبیت از بازار سهام در فروردین

قیمت جهانی طلا امروز ۱۴۰۳/۰۲/۰۱

افتتاح بزرگترین کارخانه فروسیلیس ایران در دامغان طی سفر دولت سیزدهم

ثبت بالاترین میزان تاریخ تولید فولاد ایران در سال ۱۴۰۲

کشف یک تن شیشه از بار ۲۰ تنی سنگ معدن تریلی توقیفی

تحقق شعار سال ۱۴۰۳، نیازمند ایجاد شرکتهای پروژهمحور است

دستورالعمل تنظیم بازار ورق گرم فولادی بازبینی میشود

دومین رکورد تناژ تولیدی تاریخ فولاد اکسین شکسته شد

اطلاعیه جدید بانک مرکزی درباره تخصیص ارز

چاپ ایران چک ۵۰۰ هزار تومانی تکذیب شد

حمایت ۲.۵۵۰ همتی صندوق تثبیت بازار سرمایه از بازار سهام در فروردین ۱۴۰۳