افزایش هزینههای انرژی تولید آلومینیوم برزیل را کاهش داد

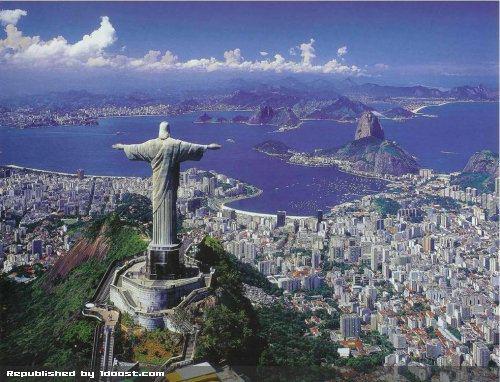

برزیل با دارا بودن ذخایر عظیمی از بوکسیت (کانی اصلی برای تولید آلومینیوم) یکی از مهمترین کشورها در صنعت بالادستی آلومینیوم بهشمار میرود. بنا به آخرین آمار منتشر شده، مجموع ذخایر بوکسیت این کشور بالغ بر ۲.۶ میلیارد تن برآورد شده است. این مقدار از ذخیره معدنی بوکسیت، برزیل را در رتبه سوم، بعد از کشورهای گینه و استرالیا، از لحاظ ذخایر بوکسیت در جهان قرار میدهد. این کشور در حال حاضر، دارای ۵ معدن بزرگ فعال در حوزه استخراج بوکسیت، ۶ واحد پالایشگاه بوکسیت و تولید آلومینا و ۳ واحد فعال ذوب آلومینیوم است. حجم پالایش آلومینا و تولید آلومینیوم این کشور، برزیل را در رتبه سوم و از لحاظ تولید آلومینیوم در رتبه یازدهم قرار میدهد. مجموع ظرفیت پالایش آلومینای برزیل به حدود ۱۰.۸ میلیون تن در سال و مجموع ظرفیت تولید آلومینیوم این کشور به حدود ۱.۴ میلیون تن میرسد.

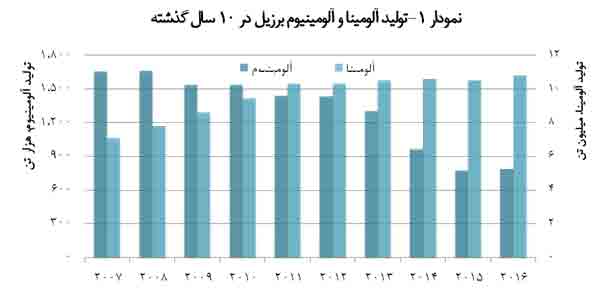

نمودار ۱، میزان تولید آلومینیوم و آلومینای برزیل را در چند سال اخیر نشان میدهد. همانطور که در این نمودار مشاهده میشود، طی ۱۰ سال گذشته حجم تولید آلومینیوم برزیل با کاهش همراه بوده، در حالی بر میزان تولید آلومینای این کشور افزوده شده است. با توجه به دادههای نمودار ۱، برزیل در سال ۲۰۱۶ در حدود ۷۹۰ هزار تن آلومینیوم تولید کرد که این رقم حاکی از نرخ بهرهوری بسیار پایین در حدود ۵۶ درصدی این کشور بود. یکی از مهمترین دلایل کاهش نرخ بهرهوری در این کشور در سالهای اخیر، افزایش هزینههای تأمین انرژی بیان شده است. بدین ترتیب میتوان اذعان داشت که در چند سال اخیر، برزیل با محدودیت تقاضای داخلی آلومینیوم مواجه بوده، و از طرفی افزایش هزینههای تولید (خصوصا در بخش تأمین انرژی) طی این دوره، رقابتپذیری آلومینیوم تولید شده این کشور را با دیگر کشورها کاهش داده است، از این رو از حجم تولیدات آلومینیوم این کشور کاسته شده است.

با توجه به اینکه تأمین انرژی مورد نیاز، سهمی در حدود ۳۰ تا ۴۰ درصدی در هزینههای کل تولید آلومینیوم دارد، هر مقدار افزایش در هزینههای تأمین انرژی بهطور قابل محسوسی میتواند در روند تولید تأثیر داشته باشد. بنا به آخرین آمار منتشر شده، هزینه تأمین انرژی الکتریکی بهازای هر مگاوات ساعت در برزیل در سال ۲۰۱۴ بهطور متوسط در حدود ۲۷۳ دلار گزارش شد که نسبت به سال ۲۰۱۳، در حدود ۱۴۶ درصد افزایش یافته بود. در بخش صنعت، هزینه تأمین انرژی الکتریکی در سال ۲۰۱۴ برای کشور برزیل، حدود ۱۱۲ دلار بهازای هر مگاوات ساعت گزارش شد. با این وجود این رقم از میانگین جهانی برای بخش صنعت (۱۲۲.۶ دلار بهازای هر مگاوات ساعت) کمتر بود. برخی کارشناسان، دلیل اصلی افزایش قیمت تأمین برق را، افزایش تقاضا در برزیل برای انرژی الکتریکی در چند سال اخیر دانستهاند که با پیشرفت تکنولوژیک و توسعه شهر نشینی حاصل شده است.

نکته قابل توجه در تأمین انرژی مورد نیاز واحدهای تولیدی آلومینیوم برزیل، استفاده عمده آنها از منابع انرژی تجدیدپذیر همچون نیروگاههای برقآبی است. در کل در برزیل، نیروگاههای برقآبی سهمی در حدود ۷۲ درصدی از تأمین انرژی الکتریکی کل کشور را بر عهده دارند. علاوه بر نیروگاههای برقآبی، نیروگاههای بادی نیز سهم قابل توجهی نسبت به سایر نقاط در تأمین انرژی مورد نیاز این کشور دارند. در مجموع، ظرفیت تولید برق از انرژیهای پاک در برزیل تا پایان سال ۲۰۱۵ به بیش از ۱۴۱ گیگاوات رسید. این حجم از ظرفیت تولید برق از انرژیهای پاک، این کشور را در بین ۱۰ کشور برتر تولیدکننده پاک انرژی الکتریکی قرار داد.

فلز کمیابی که خواب را از چشم بایدن گرفته است

بازدید فرماندار و مسوولین اجرایی شهرستان سقز از روند اجرای پروژه ملی احداث کارخانه استحصال طلای سقز

تحقق شعار سال ۱۴۰۳، نیازمند ایجاد شرکتهای پروژهمحور است

اطلاعیه فرابورس برای واگذاری استقلال و پرسپولیس

مجلس بر اجرای متناسبسازی حقوق بازنشستگان مطابق با برنامه اصرار دارد

ثبت سه محدوده معدنی جدید توسط شرکت اکتشاف و حفاری صدرتامین

مراسم معارفه مدیرعامل شرکت ملی صنایع مس ایران برگزار شد

دستورالعمل تنظیم بازار ورق گرم فولادی بازبینی میشود

قیمت جهانی طلا امروز ۱۴۰۳/۰۱/۲۹

بهرهبرداری از طرح تکمیل آبرسانی به گرمسار و نیروگاه تجدیدپذیر خورشیدی

تغییرات مدیریتی با تمرکز بر اهداف فنی و توسعهای/ فسادستیزی اساس کار در ایمیدرو است

قدردان دغدغهمندی وزیر صمت درباره شرکت مس آذربایجان هستیم

رونمایی از ماشین خودران دامپتراک تولیدی یک شرکت دانشبنیان در سمنان

اولین جلسه مدیریت گروه ملی صنعتی فولاد ایران در سال ۱۴۰۳

۱۱ طرح صنعت آب و برق استان سمنان با حضور رییسجمهور بهرهبرداری شد

ثبت بالاترین میزان تاریخ تولید فولاد ایران در سال ۱۴۰۲

همت دولت در خدمت به مردم/ بهرهبرداری از دهها طرح اقتصادی و تصویب ۱۴۵ مصوبه جدید در سمنان

ضرورت تک نرخی شدن ارز برای پیشرفت صنعت فولاد کشور

تجلی؛ مسیر هموار مشارکت مردم در رشد تولید

افتتاح بزرگترین کارخانه فروسیلیس ایران در دامغان طی سفر دولت سیزدهم

ثبت بالاترین میزان تاریخ تولید فولاد ایران در سال ۱۴۰۲

تحقق شعار سال ۱۴۰۳، نیازمند ایجاد شرکتهای پروژهمحور است

دستورالعمل تنظیم بازار ورق گرم فولادی بازبینی میشود

دومین رکورد تناژ تولیدی تاریخ فولاد اکسین شکسته شد

قیمت جهانی طلا امروز ۱۴۰۳/۰۱/۲۴

اولین جلسه مدیریت گروه ملی صنعتی فولاد ایران در سال ۱۴۰۳

همت دولت در خدمت به مردم/ بهرهبرداری از دهها طرح اقتصادی و تصویب ۱۴۵ مصوبه جدید در سمنان

افتتاح نخستین طرح پیشران اقتصادی با سرمایهگذاری "ومعادن"/ سرمایهگذاری ۳.۵ میلیارد دلاری "ومعادن"