رشد تقاضای مس چین به دنبال ساخت شهر جدید ژیانگآن

یکی از برنامههای دولت چین که در راستای توسعه اقتصادی این کشور است، ساخت شهری بزرگ در منطقه جدید ژیانگآن در استان هیبِی است. رییس جمهور چین، در روز اول آوریل سال جاری، طی یک سخنرانی از طرحی دولتی برای گذار یک مرداب به نام ژیانگآن به قطب فناوری و نوآوری چین خبر داد. این طرح بزرگ دربرگیرنده ساخت شهری در این منطقه است که واقع در ۱۱۰ کیلومتری جنوب شرقی پکن و نزدیک به شهر بندری تیانجین است. وسعت این طرح به ۲ هزار کیلومترمربع میرسد و تقریبا ۳ برابر وسعت شهری به بزرگی نیویورک است.

این طرح بهمنظور کاهش فشارهای موجود پایتخت این کشور ـ پکن ـ برنامهریزی شده است. پکن از ازدحام جمعیت زیاد، آلودگی هوا و مشکلات ترافیکی بهشدت رنج میبرد. دولت مرکزی چین در این برنامه تصمیم دارد تا بسیاری از شرکتها و مؤسسات دولتی شامل دانشگاهها را از پکن به این شهر جدید منتقل کند. با اتصال مسیرهای مواصلاتی از این شهر جدید به بندر تیانجین، به نظر میرسد که رشد و توسعه شهر جدید ژیانگآن، از شهرهای بزرگ شنژن، شانگهای و یانگتسه این کشور فراتر رود. شهر بزرگ شنژن، اولین منطقه ویژه اقتصادی چین واقع در جلگه رودخانه پرل است که در سال ۱۹۸۰ ساخته شد.

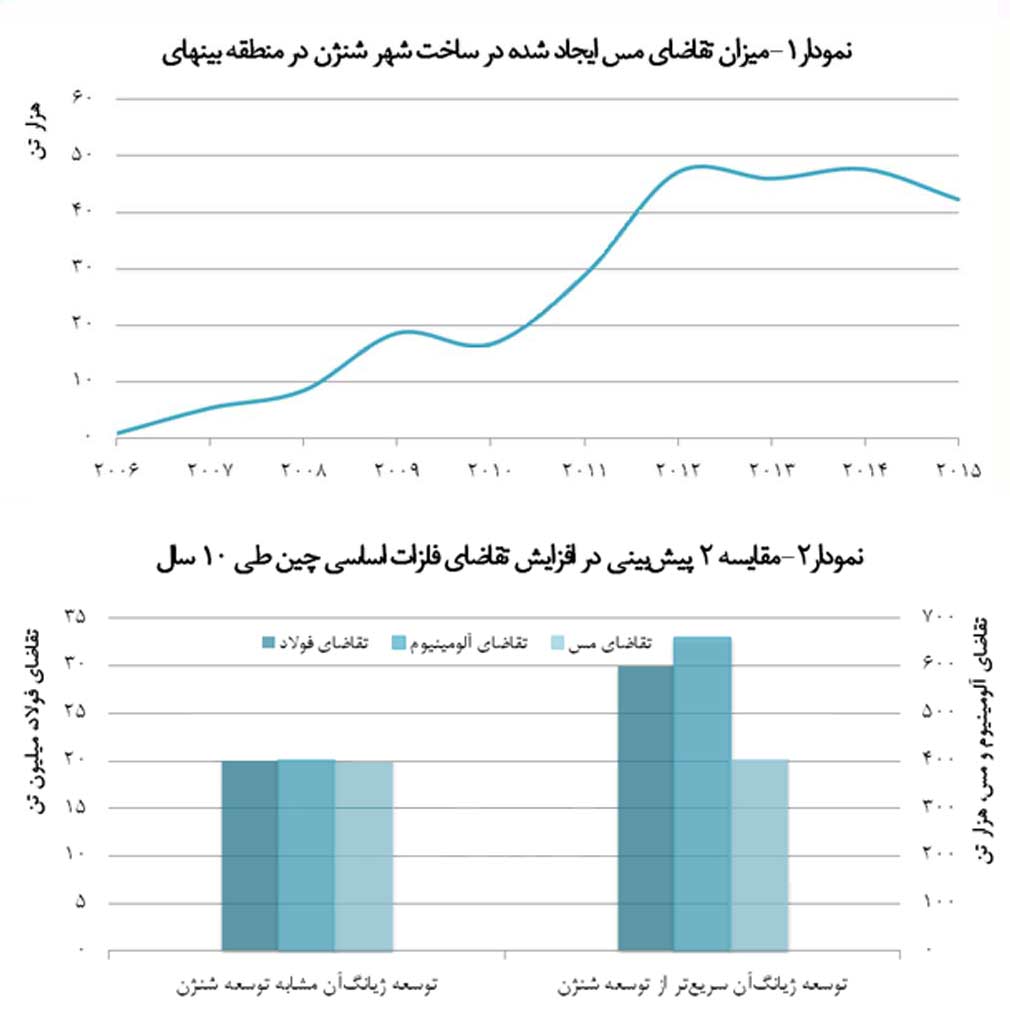

بر اساس مطالعات انجام شده، میزان تقاضای مس ایجاد شده در چین به سبب ساخت شهر شنژن در منطقه اقتصادی بینهای طی ۱۰ سال اول در نمودار ۱ نشان داده میشود. همانطور که مشاهده میشود، مطابق این نمودار، ساخت شهر شنژن که در سال ۲۰۱۵، جمعیتی حدود ۱۱ میلیون نفر با تولید ناخالص داخلی برابر با ۲۴۵ میلیارد دلار داشت، در طول ۱۰ سال اول ساخت، در مجموع مصرف مس بالغ بر ۲۶۰ هزار تن ایجاد کرد.

بنابر برآوردهای انجام شده، تأثیر سرمایهگذاری ۵۸۰ میلیارد دلاری در ساخت شهر جدید ژیانگآن بر افزایش تقاضای مس در ۱۰ سال آتی در نمودار ۲ نشان داده میشود. این نمودار، تأثیر ساخت این شهر بر میزان تقاضای فولاد، آلومینیوم و مس را براساس ۲ سناریوی مختلف مقایسه میکند. پیشبینی اول، فرآیند رشد و توسعه شهر جدید ژیانگآن مطابق با روند شهر شنژن در منطقه ویژه اقتصادی بینهای مد نظر قرار داده و پیشبینی دوم، رشدی فراتر از منطقه ویژه اقتصادی بینهای در نظر میگیرد. بر اساس پیشبینیها، اوج افزایش تقاضای فلزات اساسی در ۵ سال آخر یعنی از سال ۲۰۲۰ تا ۲۰۲۵ خواهد بود.

علاوه بر این، کمیسیون شهرداری شهر پکن، پایتخت چین، در جلسهای در مورد ساخت شهر جدید ژیانگآن و اتصال آن به ۲ شهر پکن و بندر تیانجین، به منظور کاهش ازدحام جمعیتی، بار ترافیکی و آلودگی هوای پکن و همچنین ایجاد قطب فناوری و نوآوری در این منطقه، اعلام کرد که در سال گذشته، در جهت پیشرفت ۲۶ پروژه با مجموع سرمایهگذاری ۵ میلیارد یوان معادل ۷۴۰ میلیون دلار فعالیت کرده است. این پروژهها عمدتا بر انتقال بازارهای مختلف و تجهیزات لجستیک به استان هیبِی است. بنابر آمار منتشر شده توسط شهرداری شهر پکن، جمعیت و نرخ رشد آن در این شهر، در طول ۳ سال گذشته کاهش یافته است. با این وجود، تولید ناخالص داخلی شهر پکن در سال ۲۰۱۶ با افزایش ۶.۷ درصدی نسبت به سال ۲۰۱۵ همراه بود.

تحقق شعار سال ۱۴۰۳، نیازمند ایجاد شرکتهای پروژهمحور است

دستورالعمل تنظیم بازار ورق گرم فولادی بازبینی میشود

اطلاعیه فرابورس برای واگذاری استقلال و پرسپولیس

مجلس بر اجرای متناسبسازی حقوق بازنشستگان مطابق با برنامه اصرار دارد

افتتاح نخستین طرح پیشران اقتصادی با سرمایهگذاری "ومعادن"/ سرمایهگذاری ۳.۵ میلیارد دلاری "ومعادن"

مراسم معارفه مدیرعامل شرکت ملی صنایع مس ایران برگزار شد

قیمت جهانی طلا امروز ۱۴۰۳/۰۱/۲۹

دومین رکورد تناژ تولیدی تاریخ فولاد اکسین شکسته شد

کشف یک تن شیشه از بار ۲۰ تنی سنگ معدن تریلی توقیفی

ساخت ابر پروژه فولاد استان همدان با ۳۰ هزار میلیارد ریال سرمایهگذاری

پرونده قضایی برای پنج معدن شن و ماسه زرند تشکیل شد

صنعت فولاد ایران هدف جدیدترین تحریمهای آمریکا

ادامه رشد مصرف زغال سنگ علیرغم تعهدات انرژی پاک

قراضه آهن در کانال ۳۸۲ دلار جا خوش کرد

خبرنامه شماره ۱۳۷۲ فولاد منتشر شد

تداوم توفیقات جبهه حق در عرصههای امنیتی و اقتصادی

معامله ۴۰۸۴۸۴ تن ورق فولادی در بورس کالا طی هفته چهارم فروردین

دیدار مدیرعامل و مدیران شرکت آلومینای ایران با سردار مطهریزاده فرمانده نیروی انتظامی خراسان شمالی

شرکت آلومینای ایران موهبتی الهی است که به استان عرضه شده

افتتاح بزرگترین کارخانه فروسیلیس ایران در دامغان طی سفر دولت سیزدهم

ثبت بالاترین میزان تاریخ تولید فولاد ایران در سال ۱۴۰۲

کشف یک تن شیشه از بار ۲۰ تنی سنگ معدن تریلی توقیفی

تحقق شعار سال ۱۴۰۳، نیازمند ایجاد شرکتهای پروژهمحور است

دستورالعمل تنظیم بازار ورق گرم فولادی بازبینی میشود

دومین رکورد تناژ تولیدی تاریخ فولاد اکسین شکسته شد

نیسان به چاله رسید!

برای مردمی کردن اقتصاد چه باید کرد؟

بازار سرمایه با چالش مالیاتی در لایحه بودجه مواجه شده است؟