تقاضا در کانادا، محرک توسعه تولید آلومینا در این کشور است

کانادا یکی از کشورهای مهم و فعال در حوزه معدن و متالورژی فلزات مختلف بهشمار میآید. یکی از مهمترین صنایع فلزی که کانادا نقش پر رنگی در سطح جهانی دارد، تولید آلومینیوم است. صنعت آلومینیوم بهاتکای امکان تولید ارزان قیمت انرژی الکتریکی در کانادا، طی دهههای اخیر رشد بسیار خوبی داشته است. ظرفیت تولید آلومینیوم این کشور تا پایان سال ۲۰۱۶ حدود ۳.۳ میلیون تن برآورد شد که از این میزان ظرفیت، حدود ۳.۲۵ میلیون تن تولید آلومینیوم اولیه داشت.

همین میزان از تولید گسترده آلومینیوم اولیه که عمدتا بهواسطه هزینههای تولید پایین در این کشور رونق پیدا کرده، سبب ایجاد واحدهای قابل توجهی از پالایش بوکسیت و تولید آلومینا شده است. لازم بهذکر است که حدود ۴۰ درصد هزینههای تولید آلومینیوم اولیه را هزینههای تأمین انرژی الکتریکی تشکیل میدهند این در حالی است که این کشور فاقد منبع معدنی غنی از بوکسیت است که عملیات معدنکاری و استخراج از آن صرفه اقتصادی داشته باشد. از این رو میتوان گفت که عامل اصلی توسعه واحدهای پالایش آلومینا در این کشور، بازار پر رونق مصرف آن توسط واحدهای ذوب آلومینیوم بوده است.

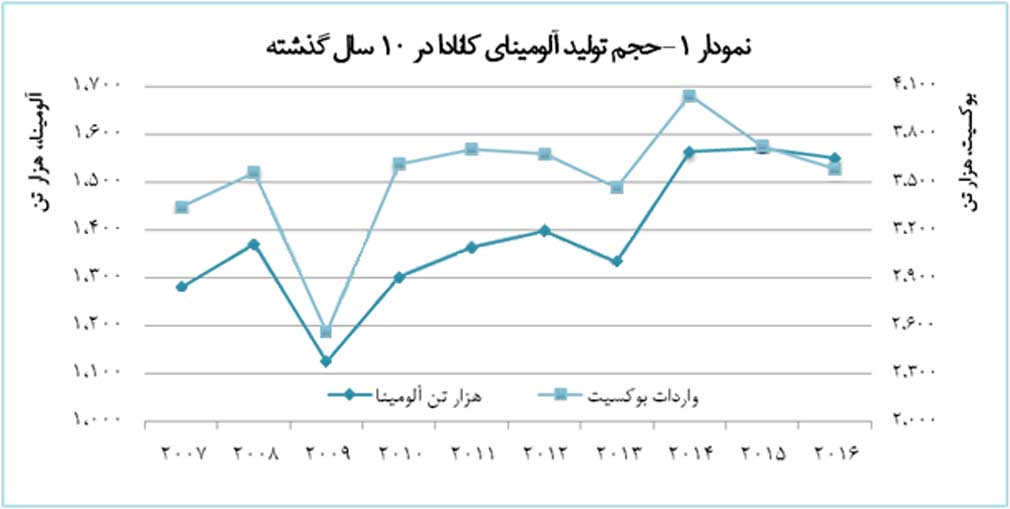

نمودار ۱، حجم تولید آلومینای کانادا طی ۱۰ سال گذشته بههمراه حجم واردات بوکسیت آن را نشان میدهد. همانطور که در این نمودار قابل مشاهده است، گرچه روند تولید آلومینای کانادا با افت و خیزهایی همراه بوده، ولی در کل میتوان اذعان داشت که حجم تولید آلومینای این کشور طی ۱۰ سال گذشته، سالانه بهطور متوسط حدود ۲.۱ درصد رشد داشته است. نکته قابل توجه در میزان تولید آلومینا، تطابق نسبی آن با حجم واردات بوکسیت آن است که عمدتا از طریق برزیل تأمین شده است.

همانطور که اشاره شد، تولید آلومینیوم اولیه کانادا نزدیک به ۳.۳ میلیون تن است. این میزان از تولید، به بیش از ۶ میلیون تن آلومینا در سال نیاز دارد. به این ترتیب بهمنظور بهرهبرداری کامل از تمام ظرفیت تولید آلومینیوم، کانادا علاوه بر تولید ۱.۵ میلیون تنی از آلومینا، سالانه باید بیش از ۴.۵ میلیون تن آلومینا را از محل واردات تأمین کند.

بررسی آمار صادرات و واردات کانادا نشان میدهد که در سال گذشته این کشور حدود ۴.۳ میلیون تن آلومینا وارد کرد که از بین کشورهای صادرکننده آلومینا به کانادا، برزیل با سهم حدود ۷۰ درصدی، بیشترین سهم را در بازار وارداتی آلومینای این کشور در اختیار داشت. با این وجود، طی سالهای مورد بررسی، کانادا همواره حدود ۱۰۰ هزار تن نیز آلومینای با خلوص بالا (برای مصارف غیر از تولید آلومینیوم) صادر کرده که ایالات متحده مهمترین مقصد صادارتی آلومینای این کشور بوده است.

با توجه به اینکه پیشبینی شده که بازار آلومینای خلوص بالا، بین دوره ۲۰۱۶ تا ۲۰۲۴، سالانه حدود ۱۶.۷ درصد رشد داشته باشد، میتوان افزایش صادرات آلومینای کانادا را از سال جاری انتظار داشت. براساس پیشبینیهای بهعمل آمده، انتظار میرود که حجم صادرات آلومینای خلوص بالای کانادا تا پایان سال جاری، نسبت به ۲ سال گذشته، رشد چشمگیر ۵۵ درصدی داشته باشد.

افتتاح نخستین طرح پیشران اقتصادی با سرمایهگذاری "ومعادن"/ سرمایهگذاری ۳.۵ میلیارد دلاری "ومعادن"

اطلاعیه فرابورس برای واگذاری استقلال و پرسپولیس

افتتاح بزرگترین کارخانه فروسیلیس ایران در دامغان طی سفر دولت سیزدهم

«فصبا» ۷۰ تومان سود تقسیم کرد

طلای جهانی از تکاپو افتاد

قیمت جهانی طلا امروز ۱۴۰۳/۰۱/۲۹

بازار طلای جهانی اندکی سرد شد

درج شرکت آلیاژ گستر هامون در بازار دوم فرابورس ایران

صبا فولاد خلیج فارس «فصبا» ۷۰ تومان سود تقسیم کرد/ پروژه احیای مستقیم «فصبا» سال ۱۴۰۵ به بهرهبرداری میرسد

نشست کارگروه راهبری بهکارگیری هوش مصنوعی در صنعت نفت برگزار شد

ضرورت نصب ۵۷ مگاوات نیروگاه خورشیدی در صنایع تهران تا ۱۴۰۶

تأمین بهینه برق صنایع در تابستان با همکاری در مدیریت مصرف

افزایش ۶ درصدی مصرف برق

وصول ۱۱۰ هزار میلیارد تومان فرار مالیاتی در سال گذشته

محصولات ویژه فولاد مبارکه در خدمت ارتقاء کیفی خودروهای داخلی

آمریکا عامل افزایش قیمت جهانی نفت

بازگشت دلار به کانال ۶۳ هزار تومان/ خریداری در بازار نیست

پیشبینی افزایش ۸۹ درصدی فروش محصولات گروه فولاد مبارکه به سایپا در سال ۱۴۰۳

دپوی ۱۳ هزار خودرو در گمرکات/ ۵۵۰۰ خودروی برقی وارد شد

وزیر صمت: شورای رقابت مسوول قیمت پژوپارس است

«تجلی» همچنان بر مدار توسعه/ آخرین خبرها از اولین شرکت پروژهمحور بورس

طلای جهانی از تکاپو افتاد

جزئیات پیشرفت پروژه عظیم مجتمع مس جانجا اعلام شد

افتتاح نخستین طرح پیشران اقتصادی کشور با سرمایهگذاری «ومعادن»

ضرورت جذب سرمایهگذاری مالی و مشارکت مردمی برای توسعه معادن

افتتاح بزرگترین کارخانه فروسیلیس ایران در دامغان طی سفر دولت سیزدهم

ثبت بالاترین میزان تاریخ تولید فولاد ایران در سال ۱۴۰۲

نشست کارگروه راهبری بهکارگیری هوش مصنوعی در صنعت نفت برگزار شد