خالص واردات قراضههای آلومینیومی آمریکا افزایش یافته است

آمریکای شمالی با ۲ تولیدکننده بزرگ آلومینیوم، یعنی کانادا و ایالات متحده آمریکا و تولید بیش از ۴ میلیون تن آلومینیوم اولیه، حدود ۱۵ درصد از تولید کل آلومینیوم اولیه را در بین کشورهای جهان غیر از چین بهخود اختصاص داد. مجموع ظرفیت تولید تنها ۲ کشور کانادا و ایالات متحده در سال ۲۰۱۶ حدود ۵ میلیون تن برآورد شد. این در حالی است که در سال ۲۰۱۶، حدود ۱۴ درصد از ظرفیت تولید ایالات متحده آمریکا بهدلیل عدم توان رقابتپذیری با محصولات آلومینیومی چینی بهصورت دائم تعطیل شدند و حدود ۴۴ درصد نیز بهصورت موقت فعالیت خود را به حالت تعلیق درآوردند. به این ترتیب، تولید آلومینیوم ایالات متحده در سال ۲۰۱۶، با ۴۷ درصد کاهش نسبت به سال ۲۰۱۵، به حدود ۸۴۰ هزار تن کاهش یافت.

کاهش تولید آلومینیوم اولیه ایالات متحده در سال گذشته که در پی تسخیر بازار آلومینیوم این کشور از سوی چینیها بود، سبب شد تا آمریکا اقدامات ضد دامپینگ را علیه محصولات آلومینیومی چینی تشدید کند. گرچه این اقدامات تا اینجا کافی نبود و آمریکا را بر آن داشت تا از سایر کشورها همچون کانادا با اِعمال اقدامات ضد دامپینگ، فشار را بر تولیدکنندگان چینی افزایش دهد. با این وجود کسری عرضه آلومینیوم اولیه در بازار ایالات متحده سبب جهتگیری مصرفکنندگان این کشور به سوی تأمین آلومینیوم از منابع ثانویه شد و بازار قراضههای آلومینیومی را در این کشور داغ کرد. به این ترتیب، تمامی مصرفکنندگان آلومینیوم آمریکا سعی کردند تا با بهبود تکنولوژیها و فرآیندهای تولید خود، سهم آلومینیوم ثانویه را در خوراک ورودی افزایش دهند. از طرف دیگر با کاهش تولید آلومینیوم اولیه، تولید قراضههای نو نیز در این کشور کاهش یافت و به گرمتر شدن بازار واردات قراضههای آلومینیومی دامن زد.

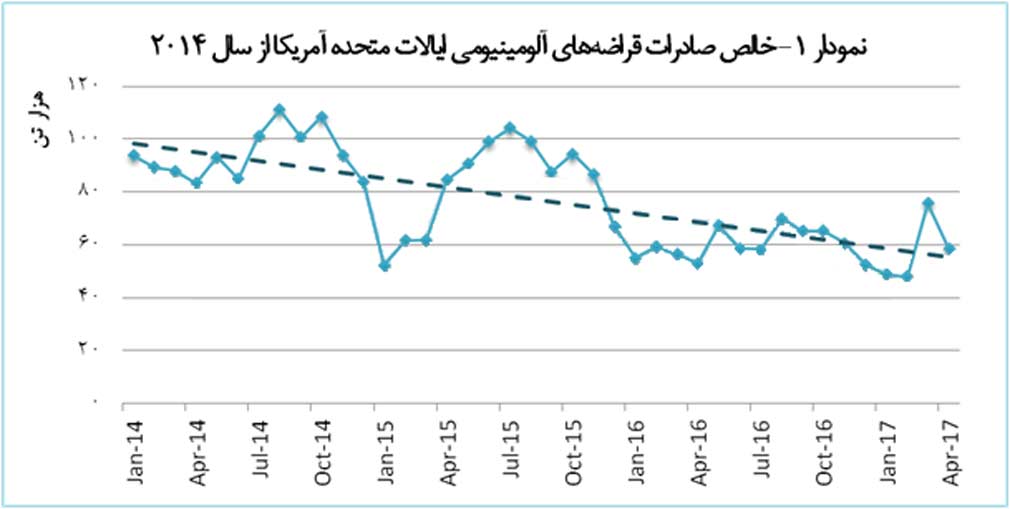

در پی این امر، صادرات قراضههای آلومینیومی از ایالات متحده آمریکا کاهش و به حجم واردات آن اضافه شد. در همین راستا، نمودار ۱، خالص صادرات قراضههای آلومینیومی ایالات متحده آمریکا را از ابتدای سال ۲۰۱۴ نشان میدهد. همانطور که در این نمودار روند نزولی خالص صادرات قراضههای آلومینیومی قابل مشاهده است، حجم صادرات خالص این محصولات از ابتدای سال ۲۰۱۴ تا ماه آوریل ۲۰۱۷، با ۳۵ درصد کاهش، از حدود ۱۰۰ هزار تن به کمتر از ۶۰ هزار تن رسید.

بر اساس این نمودار، حجم خالص صادرات قراضههای آلومینیومی از اوایل سال گذشته، همراه با تعطیلی واحدهای ذوب آلومینیوم این کشور، بهشدت کاهش یافت. گرچه میزان خالص صادرات این محصولات از آمریکا در ماه مارس سال جاری با افزایش همراه بود، اما بعد از آن با کاهش ۲۳ درصدی به حدود ۵۸ هزار تن رسید.

با توجه به اینکه بسیاری از مصرفکنندگان آلومینیوم اولیه ایالات متحده، خصوصا آن دسته از صنایعی همچون صنایع نظامی و هواپیماسازی که به آلومینیومی با خلوص بالا نیاز دارند، در پی تعطیلیهای واحدهای ذوب این کشور درصدد راهکارهایی برای تأمین آلومینیومی با خلوص بالا از منابع ثانویه برآمدند (همچون روشهایی برای تصفیه قراضههای آلومینیومی). با توجه به این، میتوان انتظار داشت که روند کاهشی خالص صادرات قراضههای آلومینیومی ایالات متحده ادامه یابد و بازار داغ منابع ثانویه آلومینیوم این کشور در ماههای آتی پابرجا باقی بماند.

طلای جهانی از تکاپو افتاد

بازار طلای جهانی اندکی سرد شد

ارزش سهام شرکت فولاد اقلید ۴ برابر شد

صنعت فولاد ایران هدف جدیدترین تحریمهای آمریکا

ساخت ابر پروژه فولاد استان همدان با ۳۰ هزار میلیارد ریال سرمایهگذاری

جزئیات پیشرفت پروژه عظیم مجتمع مس جانجا اعلام شد

انعقاد قرارداد همکاری مشترک هلدینگ تجلی با دانشگاه شهید بهشتی

«تجلی» همچنان بر مدار توسعه/ آخرین خبرها از اولین شرکت پروژهمحور بورس

تعدیل نیرو در کارخانه فروآلیاژ ازنا ناشی از افزایش تعرفه برق است

پورمختار: مراکز پژوهشی، راهکارهای عملی برای مشارکت مردم در جهش تولید ارائه کنند

افتتاح همزمان ۱۶ نیروگاه خورشیدی در ۶ استان کشور

ضرورت روزآمدسازی دانش و اطلاعات مدیران مناطق نفتخیز جنوب

مدیر شرایط اضطراری و بحران پتروشیمیهای منطقه ویژه پارس منصوب شد

کنترل و پایش خطوط تولید با نرمافزارهای بومی مبتنی بر هوش مصنوعی

خوشبینی پاکستان درباره تکمیل خط لوله گاز با ایران بهرغم هشدار آمریکا

باید ساختمانهای باشکوه در ایران ساخته شود

بهبود پایداری شبکه برق فوق توزیع منطقه دشت آزادگان

فروش اطلس، کوییک، شاهین، سهند و ساینا به قیمت کارخانه

شعار امسال با انسجام جامعه کارگری محقق خواهد شد

«تجلی» همچنان بر مدار توسعه/ آخرین خبرها از اولین شرکت پروژهمحور بورس

وزیر صمت: شورای رقابت مسوول قیمت پژوپارس است

افزایش قابل توجه صادرات مواد معدنی ترکیه پس از اقدامات انجمن صادرکنندگان مواد معدنی دریای اژه

شتابدهندههای قیمت طلای جهانی کداماند؟/ اثر عوامل سیاسی و اقتصادی بر رشد فلز زرد

طلای جهانی از تکاپو افتاد

جزئیات پیشرفت پروژه عظیم مجتمع مس جانجا اعلام شد

افتتاح نخستین طرح پیشران اقتصادی کشور با سرمایهگذاری «ومعادن»

ضرورت جذب سرمایهگذاری مالی و مشارکت مردمی برای توسعه معادن

پورمختار: مراکز پژوهشی، راهکارهای عملی برای مشارکت مردم در جهش تولید ارائه کنند