آیا جلوگیری از رشد ظرفیت آلومینیوم چین ممکن است؟

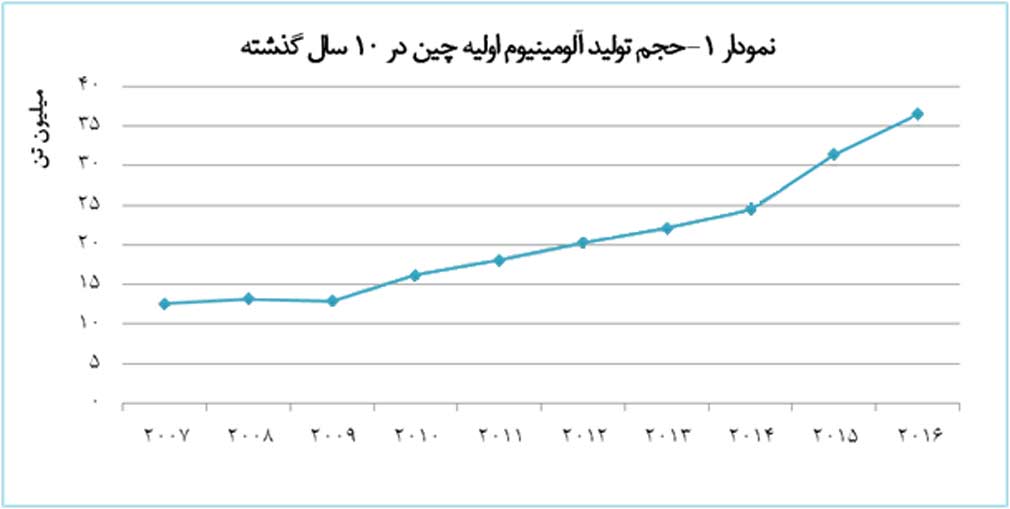

بنا به تخمینهای ارائه شده در سال ۲۰۱۶ در مورد تولید آلومینیوم کشورهای مختلف، چین در سال گذشته سهمی در حدود ۵۴ درصدی از تولید سال ۲۰۱۶ را بهخود اختصاص داد. این در حالی بود که بنا به همین گزارش، ظرفیت کل آلومینیوم چین تا پایان سال ۲۰۱۶، نزدیک به ۴۰.۱ میلیون تن تخمین زده شده بود که تنها حدود ۳۱ میلیون تن آن فعالیت میکرد و بیش از ۹ میلیون تن نیز مازاد ظرفیت تخمین زده شده بود. نمودار ۱، تولید آلومینیوم چین را برای ۱۰ سال گذشته نشان میدهد. بنا به این نمودار، نرخ رشد تولید آلومینیوم چین در ۱۰ سال گذشته، در ۲ مرحله افزایش یافته است. اولین مرحله تشدید رشد تولید آلومینیوم چین در سال ۲۰۰۹ و پس از آن در سال ۲۰۱۴ رخ داد؛ بهطور متوسط میتوان گفت که حجم تولید آلومینیوم چین در ۱۰ سال گذشته سالانه حدود ۱۳ درصد رشد داشته است.

مازاد ظرفیت تولید صنعت آلومینیوم چین فشارها را بر قیمت آلومینیوم در بازارهای جهانی تشدید کرد و به یکی از مهمترین عوامل تضعیفکننده قیمت آلومینیوم در بازارهای بینالمللی تبدیل شد. کاهش قیمت آلومینیوم به زیر سطح ۱.۶ هزار دلار بهازای هر تن، سبب زیانده شدن بسیاری از واحدهای تولیدی آلومینیوم شد و حتی برخی تا مرحله تعطیلی و ورشکستگی پیش رفتند. میتوان گفت ایالات متحده بیشترین زیان را از این نظر دید و واحدهای تولیدی بسیاری در این کشور در سال گذشته بهطور دائم و یا موقت تعطیل شدند. این در حالی بود که بهدلیل سوبسیدهای قابل توجهی که تولیدکنندگان آلومینیوم چینی از دولت این کشور دریافت میکردند، با وجود کاهش قیمت آلومینیوم به زیر ۱.۶ هزار دلار همچنان سودده بودند. البته شایان ذکر است که با از سرگیری سیاستهای انقباضی مالی دولت چین، تخصیص اعتبارات مالی صنعتگران چینی کاهش یافته است.

این امر سبب شد تا جوامع خارجی، در مرکز آنها ایالات متحده آمریکا، فشارهایی را به دولت چین برای کاهش ظرفیت تولید آلومینوم خود وارد کند. دولت چین نیز در راستای کاهش این فشارها، در سال جاری، بازرسیهایی را از واحدهای تولیدی آلومینیوم آغاز کرد تا از ادامه فعالیت واحدهایی که از لحاظ زیستمحیطی آلاینده محسوب میشود، جلوگیری کند و با این عمل از فشارهای خارجی نیز بکاهد. با این وجود، بررسیها حاکی از آن است که طی این مدت تنها کمتر از ۲ میلیون تن از ظرفیت آلومینیوم چین کاسته شده، در حالی که رشد ظرفیت این کشور طی این مدت بیشتر از آن بوده است. بنا به آخرین بررسیهای بهعمل آمده، ظرفیت کل تولید آلومینیوم چین تا پایان سال ۲۰۱۶ بالغ بر ۴۳.۲ میلیون تن بود (حدود ۳ میلیون تن بیشتر از تخمین ابتدایی) که تنها حدود ۳۰ میلیون تن از این ظرفیت، بهصورت قانونی تولید میشد. ظرفیت تولیدکنندگان غیر قانونی چین نیز، حدود ۶.۵ میلیون تن بود.

با این وجود، بنا به آخرین بررسیها، رشد ظرفیت تولید آلومینیوم چین همچنان با نرخ قابل توجهی به رشد خود ادامه میدهد؛ بهطوری که تا پایان ژوئن سال جاری، کل ظرفیت تولید آلومینیوم چین در حدود ۴۴.۷ میلیون تن گزارش شد که از آن میان، حدود ۵ میلیون تن بهطور غیر قانونی تولید میشود. ضمن اینکه چین حدود ۷ میلیون تن نیز ظرفیت در حال ساخت دارد. بدون در نظر گرفتن ظرفیت غیر قانونی در حال ساخت چین که جایگزین ظرفیتهای قدیمی میشود، حدود ۳.۵ میلیون تن ظرفیت در حال ساخت بدون مجوزهای لازم قانونی در این کشور وجود دارد. این اخبار، فشارها را بر قیمت آلومینیوم در هفتههای گذشته تشدید کرده و سبب شد تا قیمت آلومینیوم در مسیر نزولی قرار بگیرد. تنها در هفته گذشته (منتهی به ۳۰ ژوئن)، کاهش ارزش دلار فشار بر قیمت آلومینیوم در بازارهای جهانی را برداشت و سبب تغییر در مسیر قیمت آلومینیوم شد.

فلز کمیابی که خواب را از چشم بایدن گرفته است

بازدید فرماندار و مسوولین اجرایی شهرستان سقز از روند اجرای پروژه ملی احداث کارخانه استحصال طلای سقز

تحقق شعار سال ۱۴۰۳، نیازمند ایجاد شرکتهای پروژهمحور است

اطلاعیه فرابورس برای واگذاری استقلال و پرسپولیس

مجلس بر اجرای متناسبسازی حقوق بازنشستگان مطابق با برنامه اصرار دارد

ثبت سه محدوده معدنی جدید توسط شرکت اکتشاف و حفاری صدرتامین

مراسم معارفه مدیرعامل شرکت ملی صنایع مس ایران برگزار شد

دستورالعمل تنظیم بازار ورق گرم فولادی بازبینی میشود

قیمت جهانی طلا امروز ۱۴۰۳/۰۱/۲۹

بهرهبرداری از طرح تکمیل آبرسانی به گرمسار و نیروگاه تجدیدپذیر خورشیدی

تغییرات مدیریتی با تمرکز بر اهداف فنی و توسعهای/ فسادستیزی اساس کار در ایمیدرو است

قدردان دغدغهمندی وزیر صمت درباره شرکت مس آذربایجان هستیم

رونمایی از ماشین خودران دامپتراک تولیدی یک شرکت دانشبنیان در سمنان

اولین جلسه مدیریت گروه ملی صنعتی فولاد ایران در سال ۱۴۰۳

۱۱ طرح صنعت آب و برق استان سمنان با حضور رییسجمهور بهرهبرداری شد

ثبت بالاترین میزان تاریخ تولید فولاد ایران در سال ۱۴۰۲

همت دولت در خدمت به مردم/ بهرهبرداری از دهها طرح اقتصادی و تصویب ۱۴۵ مصوبه جدید در سمنان

ضرورت تک نرخی شدن ارز برای پیشرفت صنعت فولاد کشور

تجلی؛ مسیر هموار مشارکت مردم در رشد تولید

افتتاح بزرگترین کارخانه فروسیلیس ایران در دامغان طی سفر دولت سیزدهم

ثبت بالاترین میزان تاریخ تولید فولاد ایران در سال ۱۴۰۲

تحقق شعار سال ۱۴۰۳، نیازمند ایجاد شرکتهای پروژهمحور است

دستورالعمل تنظیم بازار ورق گرم فولادی بازبینی میشود

دومین رکورد تناژ تولیدی تاریخ فولاد اکسین شکسته شد

قیمت جهانی طلا امروز ۱۴۰۳/۰۱/۲۴

اولین جلسه مدیریت گروه ملی صنعتی فولاد ایران در سال ۱۴۰۳

همت دولت در خدمت به مردم/ بهرهبرداری از دهها طرح اقتصادی و تصویب ۱۴۵ مصوبه جدید در سمنان

افتتاح نخستین طرح پیشران اقتصادی با سرمایهگذاری "ومعادن"/ سرمایهگذاری ۳.۵ میلیارد دلاری "ومعادن"