بحران آب اصفهان را تا ۱۰سال دیگر نابود میکند

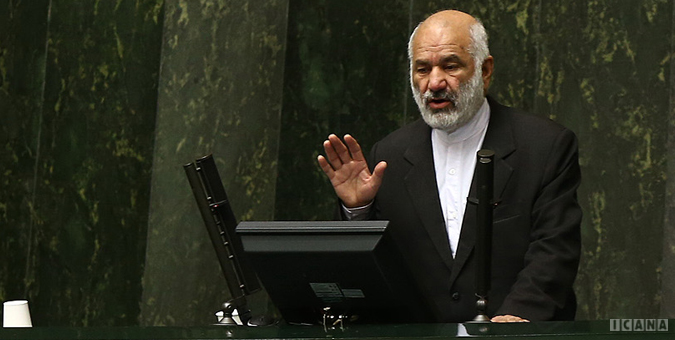

حسن کامران دستجردی در جلسه علنی امروز (سه شنبه، 27 تیرماه) مجلس شورای اسلامی در نطق میان دستور مجلس شورای اسلامی ضمن تسلیت شهادت امام جعفرصادق(ع) گفت: مکتب جعفری امروز در جهان اسلام گسترش یافته و یکی از شاگردان برجسته این مکتب حضرت آیت الله سیستانی به گونه ای عمل کرده که امروز تحولات منطقه به خصوص عراق را شاهد هستیم همچنین سرباز این مکتب، سردار سلیمانی فرمانده قدس سپاه به گونه ای عمل کرده که انشاءالله در آینده، داعش در سوریه به گور می رود و دست راست صهیونیست ها روسیاه می شوند.

نماینده مردم اصفهان در مجلس شورای اسلامی در ادامه ضمن تشکر از مردم اصفهان برای اعتماد به وی برای حضور در مجلس عنوان کرد: اصفهان به لحاظ تعداد شهدا و فرماندهان حاضر در حوزه امنیت و نظامی گری به امنیت پایدار ایران اسلامی کمک می کند همچنین در مالیات بیش از استان های دیگر کمک می کند اما در اعتبارات در ردیف آخر است در حالی که به آن می گویند استان برخورداری است.

وی در ادامه با بیان اینکه مردم شهیدپرور اصفهان همواره در راه انقلاب بدون توقع ایثارگری کرده اند، افزود: امروز باید وزرای کارآمدی در کابینه دولت دوازدهم حاضر شوند و مشکل دولت ها تا کنون این بود که فرمانده اقتصادی نداشته که همین باعث ایجاد مشکلات فراوان شده است که نمونه آن مشکلات صندوق ها است.

کامران در ادامه با بیان اینکه در ماده 142 قانون اساسی گفته شده مدیران ثروت خود را اعلام کنند، عنوان کرد: اقتصاد مقاومتی زمانی اتفاق می افتد که حاکم بر خود سخت گیر باشد و مدیر جسور و شجاع معرفی کند همچنین برنامه ششم بر همسان سازی کارگران تأکید دارد.

این نماینده مردم در مجلس دهم در ادامه با اشاره به مطالبات کارگران، آموزش و پرورش، نیروهای مسلح و ایثارگران اظهار کرد: رسیدگی به مطالبات این افراد در برنامه ششم آمده و حتی مطالبات نیروهای مسلح به صورت قانون دائم درآمده، اما شاهد آن هستیم که حتی در جاهایی ایثارگران را از کار اخراج می کنند.

وی در ادامه با اشاره به مشکلات آب اصفهان یادآور شد: رودخانه اصفهان خشک شده و دولت نباید حق آبه مردم را بفروشد که تخلف است و شورای عالی آب نیز در این زمینه کاری نکرده در حالی که شورای امنیت گفته است باید با متخلفان برخورد شود.

کامران دستجردی اضافه کرد: اگر در اصفهان یا هر استان دیگری در حوزه آب تخلفی صورت گرفت، باید با آن برخورد شود که وظیفه شورای عالی آب نیز همین است و باید مانع طرح های توسعه جدید شود.

وی در ادامه با بیان اینکه امروز بیش از 5 میلیون اصفهانی مشکل آب شرب دارند، خاطرنشان کرد: باید به موضوع آب ملی فکر کرد و برای حل آن تسهیلات قرار داد که با وضعیت فعلی تا 10 سال دیگر اصفهان نابود می شود.

عضو کمیسیون شوراها و امور داخلی کشور در مجلس شورای اسلامی در پایان خاطرنشان کرد: لایحه حمایت از معلولان در مجلس خوابیده است که باید با توجه به قرار گرفتن در آستانه روز بهزیستی به آن توجه شود چرا که بهزیستی برای یک عصا، حلزون گوش یا عینک درمانده است.

تحقق شعار سال ۱۴۰۳، نیازمند ایجاد شرکتهای پروژهمحور است

دستورالعمل تنظیم بازار ورق گرم فولادی بازبینی میشود

اطلاعیه فرابورس برای واگذاری استقلال و پرسپولیس

مجلس بر اجرای متناسبسازی حقوق بازنشستگان مطابق با برنامه اصرار دارد

مراسم معارفه مدیرعامل شرکت ملی صنایع مس ایران برگزار شد

قیمت جهانی طلا امروز ۱۴۰۳/۰۱/۲۹

افتتاح نخستین طرح پیشران اقتصادی با سرمایهگذاری "ومعادن"/ سرمایهگذاری ۳.۵ میلیارد دلاری "ومعادن"

دومین رکورد تناژ تولیدی تاریخ فولاد اکسین شکسته شد

کشف یک تن شیشه از بار ۲۰ تنی سنگ معدن تریلی توقیفی

بیانیه فولاد خوزستان در محکومیت دور جدید تحریمهای آمریکا علیه این شرکت/ فعالیت خود را با اقتدار و اثربخشی بیش از پیش ادامه میدهیم

فاصله بین قیمت جهانی و بهای واقعی فولاد تولیدی به جیب دولت میرود

نوسانات ارز همه ابعاد اقتصادی زندگی مردم را تحت تاثیر قرار میدهد/ دولت جدی ورود کند

نابسامانی بازار خودرو ناشی از بیتوجهی دولت به واردات است

رهبران اروپا اقتصاد را نابود کردند

طرح اصلاح جریان مالی صنعت برق وارد مرحله اجرایی شد

اوپک میتواند مانع ۱۰۰ دلاری شدن قیمت نفت شود

قیمت جهانی طلا امروز ۱۴۰۳/۰۱/۳۱

سقوط قیمت بیتکوین تا زیر ۶۰ هزار دلار

اطلاعیه جدید بانک مرکزی درباره تخصیص ارز

افتتاح بزرگترین کارخانه فروسیلیس ایران در دامغان طی سفر دولت سیزدهم

ثبت بالاترین میزان تاریخ تولید فولاد ایران در سال ۱۴۰۲

کشف یک تن شیشه از بار ۲۰ تنی سنگ معدن تریلی توقیفی

تحقق شعار سال ۱۴۰۳، نیازمند ایجاد شرکتهای پروژهمحور است

دستورالعمل تنظیم بازار ورق گرم فولادی بازبینی میشود

دومین رکورد تناژ تولیدی تاریخ فولاد اکسین شکسته شد

اطلاعیه جدید بانک مرکزی درباره تخصیص ارز

چاپ ایران چک ۵۰۰ هزار تومانی تکذیب شد

حمایت ۲.۵۵۰ همتی صندوق تثبیت بازار سرمایه از بازار سهام در فروردین ۱۴۰۳