مفتول اصلیترین محصول آلومینیومی صادراتی بحرین بود

حرین را میتوان از پایهگذاران صنعت آلومینیوم در منطقه خاورمیانه دانست. شرکت آلومینیوم بحرین (آلبا) که در سال 1968 تأسیس شد، برای نخستین بار تولید آلومینیوم را از سال 1971 با ظرفیت 120 هزار تن آغاز کرد. گرچه به فاصله چند ماه بعد، شرکت آلومینیوم ایران (ایرالکو) نیز تولید آلومینیوم را از سر گرفت، از این رو بسیاری بحرین و ایران را از پایهگذاران صنعت آلومینیوم در خاورمیانه دانستهاند. با این حال، همزمان با توسعه صنعت آلومینیوم در خاورمیانه و شکلگیری آن در سایر کشورهای منطقه، این صنعت در بحرین نیز توسعه یافت؛ به این صورت که امروزه شرکت آلومینیوم بحرین (آلبا) با تولید بیش از 960 هزار تن آلومینیوم در سال گذشته در جایگاه دوم از منظر بزرگترین تولیدکنندگان خاورمیانه قرار گرفت. این در حالی است که ایران در سال گذشته حدود 341 هزار تن آلومینیوم تولید کرد که آن را از بین 6 کشور فعال خاورمیانه در حوزه صنعت آلومینیوم، در جایگاه ششم قرار داد.

صنعت آلومینیوم بحرین، از زمان تولد (1971) تا به امروز نهتنها به صورت افقی (در راستای افزایش ظرفیت تولید) بلکه بهصورت عمودی نیز توسعه یافته است؛ به این معنی که با افزایش حلقههای تولید از زنجیره تأمین صنعت آلومینیوم و توسعه بخشهای پاییندستی، به تولید محصولات پاییندستی آلومینیوم مبادرت ورزیده است. یکی از مهمترین ویژگیهای صنعت آلومینیوم در بحرین، شکلگیری واحدهای پاییندست این صنعت در مجاورت واحد ذوب آلومینیوم است تا بتوانند بدون نیاز به ذوب دوباره آلومینیوم، از مذاب تولید شده در واحد ذوب آلبا، مستقیما برای تولید سایر محصولات پاییندست آلومینیوم استفاده کنند. علاوه بر آن، مقرر شدن واحدهای اکستروژن در مجاورت آلبا نیز، هزینههای جابهجایی بیلتهای آلومینیوم را برای انتقال به این واحدها به میزان قابل توجهی کاهش داده است. این امر سبب شده تا بحرین بهواسطه بخشهای پاییندست آلومینیوم خود، به یکی از بزرگترین مصرفکنندگان آلومینیوم (اولیه) در منطقه تبدیل شود. از حلقههای مختلف پاییندست زنجیره تأمین صنعت آلومینیوم بحرین، ظرفیت تولید محصولات اکستروژن و سیمومفتول آلومینیومی به مقدار قابل ملاحظهای توسعه یافتهاند؛ تا جایی که حجم صادرات سیم و مفتول آلومینیومی از بحرین در سال گذشته، بیش از 5 برابر حجم محصولات کار نشده آلومینیومی این کشور گزارش شد.

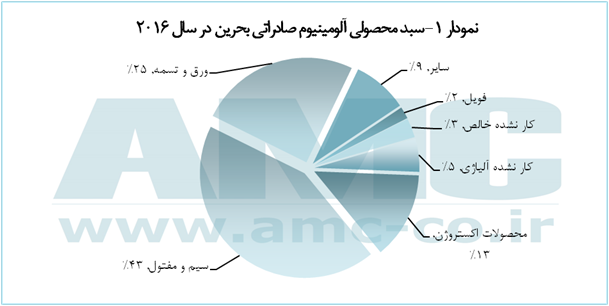

نمودار 1، سبد محصولی آلومینیوم صادراتی بحرین در سال گذشته را نشان میدهد. همانطور که در این نمودار مشاهده میشود، سیم و مفتول آلومینیومی سهم 43 درصدی از صادرات محصولات آلومینیومی بحرین را در سال گذشته بهخود اختصاص داد که عمدتا به مقصد ایالات متحده آمریکا صادر شد. پس از آن، ورق و تسمههای آلومینیومی اصلیترین محصول صادراتی بحرین در صنعت آلومینیوم بود. نکته قابل توجه در این نمودار، سهم محصولات کار نشده آلومینیومی، خصوصا کار نشدههای خالص است که تنها سهم 3 درصدی از صادرات آلومینیوم این کشور را در اختیار خود گرفت. به این ترتیب، آلومینیوم اولیه تولید شده در شرکت آلبا، بهطور مستقیم بخش خیلی کوچکی از ارزآوری صنعت آلومینیوم این کشور را در اختیار دارد و عمده ارزآوری صنعت آلومینیوم بحرین برپایه صادرات محصولات پاییندست این کشور بنا شده است.

افتتاح نخستین طرح پیشران اقتصادی با سرمایهگذاری "ومعادن"/ سرمایهگذاری ۳.۵ میلیارد دلاری "ومعادن"

اطلاعیه فرابورس برای واگذاری استقلال و پرسپولیس

افتتاح بزرگترین کارخانه فروسیلیس ایران در دامغان طی سفر دولت سیزدهم

«فصبا» ۷۰ تومان سود تقسیم کرد

قیمت جهانی طلا امروز ۱۴۰۳/۰۱/۲۹

طلای جهانی از تکاپو افتاد

بازار طلای جهانی اندکی سرد شد

صبا فولاد خلیج فارس «فصبا» ۷۰ تومان سود تقسیم کرد/ پروژه احیای مستقیم «فصبا» سال ۱۴۰۵ به بهرهبرداری میرسد

درج شرکت آلیاژ گستر هامون در بازار دوم فرابورس ایران

دلار مبادلهای واردکانال جدید شد/ قیمت: ۴۴ هزار و ۳۸ تومان

بحران فرونشست در ۳۵۹ دشت کشور

دستیابی به ظرفیت اسمی در واحد زمزم ۳، تبلور افتخار، اقتدار و ایستادگی است

سنگ آهن ارزانتر شد

نگاهی به آخرین تحولات بازار جهانی قراضه

بازار واردات ورق خاورمیانه تحت تاثیر سیل دوبی

چشمانداز بازار فولاد آسیا، منفی

کاهش تولید جهانی فولاد خام

فنآوری جدید بازیافت لیتیوم از پسماندها

مشارکت مردم در جهش تولید چگونه عملی میشود؟

وزیر صمت: شورای رقابت مسوول قیمت پژوپارس است

«تجلی» همچنان بر مدار توسعه/ آخرین خبرها از اولین شرکت پروژهمحور بورس

جزئیات پیشرفت پروژه عظیم مجتمع مس جانجا اعلام شد

افتتاح نخستین طرح پیشران اقتصادی کشور با سرمایهگذاری «ومعادن»

ضرورت جذب سرمایهگذاری مالی و مشارکت مردمی برای توسعه معادن

افتتاح بزرگترین کارخانه فروسیلیس ایران در دامغان طی سفر دولت سیزدهم

ثبت بالاترین میزان تاریخ تولید فولاد ایران در سال ۱۴۰۲

دستیابی به ظرفیت اسمی در واحد زمزم ۳، تبلور افتخار، اقتدار و ایستادگی است