ظرفیت آلومینیوم رو به رشد چین، بازار آلومینا را بیش از گذشته داغ کرده است

شرکت ملی آلومینیوم هند (نالکو) همواره یکی از بزرگترین تولیدکنندگان آلومنییوم هند بهشمار رفته است. این شرکت در سال مالی گذشته (که از ابتدای آوریل هر سال تا پایان ماه مارس سال بعد را تشکیل میدهد) بیش از 372 هزار تن آلومینیوم تولید کرد. با وجود اینکه حوزه فعالیت این شرکت، تمامی حلقههای بخش بالادستی از زنجیره تأمین صنعت آلومینیوم را شامل شده و حتی در تولید و فروش انرژی الکتریکی نیز فعالیت دارد، اما عمده تمرکز این شرکت در سالهای اخیر بر حلقه تولید آلومینا معطوف بوده است. مزیت تولید آلومینا، حاشیه سود بیشتر آن بهازای واحد آلومینیوم محتوی، در مقایسه با سایر محصولات بالادستی از جمله بوکسیت و شمش آلومینیوم است. از این رو بسیاری از شرکتهایی که دسترسی به منابع اولیه تولید آلومینا (بوکسیت) دارند، تلاش کردهاند تا این بخش از ظرفیت تولید خود را توسعه دهند.

در همین راستا نیز، شرکت نالکوی هند، بهعنوان یکی از مهمترین تولیدکنندگان و صادرکنندگان آلومینای هند، در تلاش است تا نرخ بهرهبرداری از ظرفیت تولید آلومینای خود را در سال جاری افزایش دهد. علاوه بر دسترسی به منابع غنی بوکسیت، واحدهای پالایش آلومینای نالکو بهواسطه بهرهمندی از نیروی کاری ارزان قیمت و استفاده از فرآیندهای تولید بهینه، موفق به ثبت کمترین هزینه تولید آلومینا در جهان شده است. مضاف بر آن، ساختار تعرفه و مالیاتهای جدید هند در سال جاری، سبب شده تا از قیمت تأمین زغالسنگ برای فعالان بالادستی صنعت آلومینیوم، بین 2 تا 3 درصد کاسته شود. این امر نیز بر کاهش بیشتر هزینههای تولید شرکت نالکو مؤثر بوده و این شرکت را بر آن داشته تا از شرایط کنونی ایجاد شده نهایت استفاده را ببرد و جایگاه خود را در بازار رقابتی صنعت آلومینیوم، خصوصا در مورد محصول آلومینا، ارتقا بخشد.

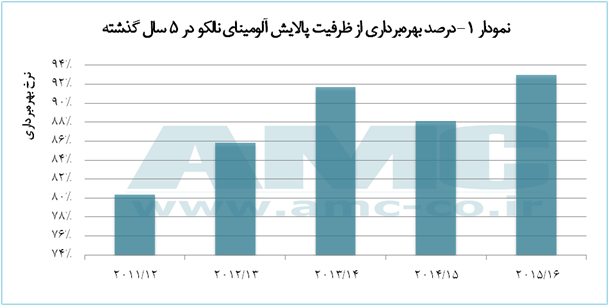

نمودار 1، میزان نرخ بهرهبرداری از ظرفیت پالایش آلومینای نالکو را در چند سال گذشته (براساس سال مالی عنوان شده) نشان میدهد. همانطور که در این نمودار قابل مشاهده است، درصد استفاده از ظرفیت تولید و پالایش آلومینای نالکو در سالهای گذشته با افت و خیزهای قابل توجهی همراه بوده است. با توجه به دادههای نشان داده شده در این نمودار، میتوان گفت که در 5 سال گذشته، نرخ بهرهبرداری در پالابشگاههای نالکو بهطور متوسط کمتر از 88 درصد بوده است. با این حال، حداکثر نرخ بهرهبرداری از ظرفیت آلومینای نالکو، در سال مالی گذشته به بیشترین میزان خود در 5 سال گذشته رسید و از مرز 93 درصد نیز فراتر رفت.

نکته قابل توجه، سوق تمرکز نالکو به تولید آلومینا است. همانطور که پیشتر اشاره شد، تولید این محصول حاشیه سود بیشتری را بهازای هر تن آلومینیوم بههمراه خواهد داشت. علاوه بر آن، در شرایط کنونی بازار آلومینیوم که با عرضه رو به رشد چین مواجه است، سبب داغتر شدن تقاضای آلومینا خواهد شد. بازار آلومینیوم در حالی تحت فشار عرضه چین قرار گرفته که با وجود اقدامات جدی دولت چین بر کاهش ظرفیت آلومینیوم این کشور، همچنان روند سریع رشد تولید آلومینیوم چین، ادامه دارد. در چنین شرایطی، استراتژی نالکو بر تغییر تمرکز از روی آلومینیوم بر محصول آلومینا بوده تا به این طریق نهتنها از گزند مازاد عرضه آلومینیوم بیشتر در امان بماند، بلکه بتواند سهم بیشتری از تقاضا و بازار آلومینای چین را تصاحب کند که بهواسطه شکلگیری ظرفیتهای عظیم تولید آلومینیوم در حال رشد است. در همین راستا، شرکت نالکو پیشبینی کرده که حجم تولید آلومینای این شرکت در سال جاری حتی فراتر زا ظرفیت عملی 2.1 میلیون تنی نیز برود. علاوه بر آن، این شرکت عمده پروژههای خارجی خود را (از جمله پروژه مشترک احداث واحد تولید آلومینیوم در ایران) به حالت تعلیق درآورده تا بتواند به سرعتبخشی تکمیل پروژههای داخلی، خصوصا پروژههای تولید آلومینا، کمک شایانی کرده باشد.

طلای جهانی از تکاپو افتاد

بازار طلای جهانی اندکی سرد شد

ارزش سهام شرکت فولاد اقلید ۴ برابر شد

صنعت فولاد ایران هدف جدیدترین تحریمهای آمریکا

ساخت ابر پروژه فولاد استان همدان با ۳۰ هزار میلیارد ریال سرمایهگذاری

جزئیات پیشرفت پروژه عظیم مجتمع مس جانجا اعلام شد

«تجلی» همچنان بر مدار توسعه/ آخرین خبرها از اولین شرکت پروژهمحور بورس

انعقاد قرارداد همکاری مشترک هلدینگ تجلی با دانشگاه شهید بهشتی

تعدیل نیرو در کارخانه فروآلیاژ ازنا ناشی از افزایش تعرفه برق است

پورمختار: مراکز پژوهشی، راهکارهای عملی برای مشارکت مردم در جهش تولید ارائه کنند

افتتاح همزمان ۱۶ نیروگاه خورشیدی در ۶ استان کشور

ضرورت روزآمدسازی دانش و اطلاعات مدیران مناطق نفتخیز جنوب

مدیر شرایط اضطراری و بحران پتروشیمیهای منطقه ویژه پارس منصوب شد

کنترل و پایش خطوط تولید با نرمافزارهای بومی مبتنی بر هوش مصنوعی

خوشبینی پاکستان درباره تکمیل خط لوله گاز با ایران بهرغم هشدار آمریکا

باید ساختمانهای باشکوه در ایران ساخته شود

بهبود پایداری شبکه برق فوق توزیع منطقه دشت آزادگان

فروش اطلس، کوییک، شاهین، سهند و ساینا به قیمت کارخانه

شعار امسال با انسجام جامعه کارگری محقق خواهد شد

«تجلی» همچنان بر مدار توسعه/ آخرین خبرها از اولین شرکت پروژهمحور بورس

وزیر صمت: شورای رقابت مسوول قیمت پژوپارس است

افزایش قابل توجه صادرات مواد معدنی ترکیه پس از اقدامات انجمن صادرکنندگان مواد معدنی دریای اژه

شتابدهندههای قیمت طلای جهانی کداماند؟/ اثر عوامل سیاسی و اقتصادی بر رشد فلز زرد

طلای جهانی از تکاپو افتاد

جزئیات پیشرفت پروژه عظیم مجتمع مس جانجا اعلام شد

افتتاح نخستین طرح پیشران اقتصادی کشور با سرمایهگذاری «ومعادن»

ضرورت جذب سرمایهگذاری مالی و مشارکت مردمی برای توسعه معادن

پورمختار: مراکز پژوهشی، راهکارهای عملی برای مشارکت مردم در جهش تولید ارائه کنند