کشورهای خاورمیانه سهم خود را در بازار آلومینیوم اروپای غربی افزایش دادند

در بررسیهای مختلف بهعمل آمده بین میزان مصرف فلزات پایه بهازای هر نفر در کشورهای مختلف، با مقدار سرانه تولید ناخالص داخلی آنها مشخص شده که همواره رابطه مستقیمی بین این 2 پارامتر وجود دارد؛ به این صورت که در کشورهای پیشرفته که عمدتا دارای سرانه تولید ناخالص داخلی بالایی نسبت به سایر کشورها هستند، همواره سرانه مصرف بیشتری از فلزات پایه و فلزات پرکابرد نیز دارند. در بین فلزات پایه، آلومینیوم بهعنوان مهمترین و پرکاربردترین فلز پایه، از این امر مستثنی نیست. از این رو، چنین مطالعاتی، جایگاه ویژه فلزاتی همچون آلومینیوم را در جوامع پیشرفته بهخوبی نمایان میکند.

بررسی بین آمار صادرات و واردات آلومینیوم نیز در جهان حاکی از آن است که تجارت بینالمللی در بین کشورهای پیشرفته به مقدار قابل توجهی بیشتر از سایر کشورها است. منطقه اروپای غربی، بهعنوان شاخصترین منطقه از لحاظ مدرنیته بودن، در سال گذشته سهم قابل توجهی چه در مورد واردات و چه در مورد صادرات بهخود اختصاص داد. در مجموع در سال گذشته، حجم کل واردات و صادرات انجام شده در کشورهای اروپای غربی بهترتریب به حدود 10.4 و 10.8 میلیون تن رسید. این امر در حالی بود که در سال گذشته بالغ بر 3.8 میلیون تن آلومینیوم اولیه در کشورهای واقع در منطقه غربی اروپا تولید شد. بنا به این آمار میتوان گفت که تجارت بین کشوری در منطقه اروپای غربی از اهمیت ویژهای برخوردار است. از این رو، بررسی مقدار ورود و خروج آلومینیوم از این منطقه میتواند نشانگر حجم تبادلات بین کشورهای خود منطقه با کشورهای خارج از این منطقه را نشان دهد که از اهمیت بالایی برخوردار است.

در بررسی بین مهمترین کشورهای واردکننده انواع شمش آلومینیومی در منطقه اروپای غربی، باید گفت که کشورهای آلمان، ایتالیا، فرانسه، اسپانیا، هلند و بلژیک بیشترین حجم واردات از این محصولات را در سال گذشته داشتند. مجموع حجم واردات این کشورها در سال گذشته، بیش از 70 درصد کل واردات کشورهای منطقه اروپای غربی را بهخوداختصاص داد. از این رو در ادامه، آمار واردات آلومینیوم این کشورها بهعنوان کشورهای شاخص اروپای غربی مورد بررسی قرار میگیرند.

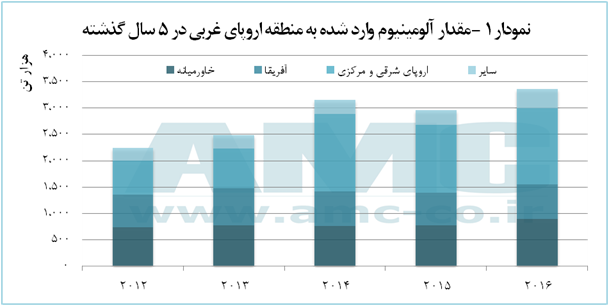

نمودار 1، حجم واردات شمش آلومینیوم مهمترین کشورهای واردکننده اروپای غربی از کشورهای خارج از این منطقه را نشان میدهد. همانطور که در این نمودار مشاهده میشود در 5 سال گذشته، کشورهای مناطق خاورمیانه، آفریقا و کشورهای اروپای مرکزی و شرقی اصلیترین واردکنندگان به منطقه اروپای غربی بودند؛ به این معنی که عمده آلومینیوم وارد شده به منطقه اروپای غربی از کشورهای این مناطق انجام شده است. در مجموع در سال گذشته نزدیک به 3.36 میلیون تن شمش آلومینیوم به این منطقه وارد شد که در 5 سال گذشته، حدود 10.7 درصد رشد سالانه داشته است. در این بین، قسمت اعظمی از شمش آلومینوم وارد شده به منطقه اروپای غربی از کشورهای اروپای شرقی و مرکزی صورت گرفت. پس از آن، خاورمیانه با متوسط صادرات 786 هزار تن در 5 سال گذشته اصلیترین صادرکننده این محصولات به منطقه اروپای غربی به شمار رفت.

با مقایسه بین سهم کشورهای اروپای شرقی و مرکزی با کشورهای خاورمیانه میتوان گفت که کشورهای اروپای شرقی و مرکزی در 5 سال اخیر بهطور چشمگیری سهم خود را در بازار اروپای غربی افزایش دادهاند، در حالی که سهم خاورمیانه در 5 سال گذشته نسبتا ثابت باقی مانده است. متوسط رشد سالانه صادرات کشورهای اروپای شرقی و مرکزی به اروپای غربی حدود 22.7 درصد برآورد میشود که این رقم برای خاورمیانه در حدود 4.9 درصد بود. با این حال با توجه به مزیت نزدیکی کشورهای اروپای شرقی و مرکزی به اروپای غربی و همچنین وجود شرکتهای غول تولیدکننده آلومینیوم در این کشورها باید اذعان داشت که تولیدکنندگان آلومینیوم در خاورمیانه جایگاه بسیار خوبی در بازار رقابتی اروپای غربی کسب کردهاند؛ امری که نهتنها براساس قیمت پایین و رقابتی بلکه کیفیت خوب محصولات حاصل شده است.

نکته قابل توجه در نمودار، سهم کشورهای آفریقایی در صادرات آلومینیوم به منطقه اروپای غربی است. با وجود آنکه کشورهای آفریقایی خود مصرف کمی از آلومینیوم دارند، در سالهای اخیر سهم 23 درصدی از کل شمش آلومینیوم وارد شده به منطقه اروپای غربی داشتند. توجه به این نکته ضروری است که بسیاری از شرکتهای تولیدکننده آلومینیوم اروپایی، از جمله روسال و هیدرو، واحدهای متعددی از تولید آلومینا و آلومینیوم اولیه در آفریقا احداث کردهاند تا نهتنها از نیروی کار ارزان بهره ببرد بلکه از مزیت دسترسی به منابع معدنی فراوان بوکسیت در این قاره استفاده کنند. این شرکتها قادر خواهند بود تا آلومینیوم تولید شده در این واحدها (واقع در آفریقا) را با پریمیوم کمتری به اروپا وارد کنند.

افتتاح نخستین طرح پیشران اقتصادی با سرمایهگذاری "ومعادن"/ سرمایهگذاری ۳.۵ میلیارد دلاری "ومعادن"

اطلاعیه فرابورس برای واگذاری استقلال و پرسپولیس

قیمت جهانی طلا امروز ۱۴۰۳/۰۱/۲۹

بازار طلای جهانی اندکی سرد شد

کشف یک تن شیشه از بار ۲۰ تنی سنگ معدن تریلی توقیفی

افتتاح بزرگترین کارخانه فروسیلیس ایران در دامغان طی سفر دولت سیزدهم

«فصبا» ۷۰ تومان سود تقسیم کرد

صبا فولاد خلیج فارس «فصبا» ۷۰ تومان سود تقسیم کرد/ پروژه احیای مستقیم «فصبا» سال ۱۴۰۵ به بهرهبرداری میرسد

درج شرکت آلیاژ گستر هامون در بازار دوم فرابورس ایران

۴۰ درصد معادن نیشابور فعال است

ذخیره کانسنگ منگنز معدن ونارچ قم به ۱۲ میلیون تُن رسید

آغاز فرآیند هشتمین دوره ممیزی عملکرد HSE مدیران واحدهای تابعه ایمیدرو

رشد ۱۶ درصدی ارزش سرمایهگذاریهای منطقه ویژه لامرد در سال ۱۴۰۲

خودروِ ترکیبی یا دورگه؟

حذف واسطهها و کاهش هزینه تولید طلا در پی حراج شمش در مرکز مبادله

پایان یک توقف طولانی/ گاز ایران در مسیر پاکستان

بیاعتنایی بازار نفت به اقدامات آمریکا علیه صادرات نفت ایران

ایرانخودرو ۱۹۴.۵ هزار تومان روی آریسان ۲ دوگانهسوز گذاشت

آرژانتین در سراشیبی نزول اقتصادی

وزیر صمت: شورای رقابت مسوول قیمت پژوپارس است

افتتاح نخستین طرح پیشران اقتصادی کشور با سرمایهگذاری «ومعادن»

ضرورت جذب سرمایهگذاری مالی و مشارکت مردمی برای توسعه معادن

افتتاح بزرگترین کارخانه فروسیلیس ایران در دامغان طی سفر دولت سیزدهم

ثبت بالاترین میزان تاریخ تولید فولاد ایران در سال ۱۴۰۲

کشف یک تن شیشه از بار ۲۰ تنی سنگ معدن تریلی توقیفی

خودروِ ترکیبی یا دورگه؟

حذف واسطهها و کاهش هزینه تولید طلا در پی حراج شمش در مرکز مبادله

پایان یک توقف طولانی/ گاز ایران در مسیر پاکستان