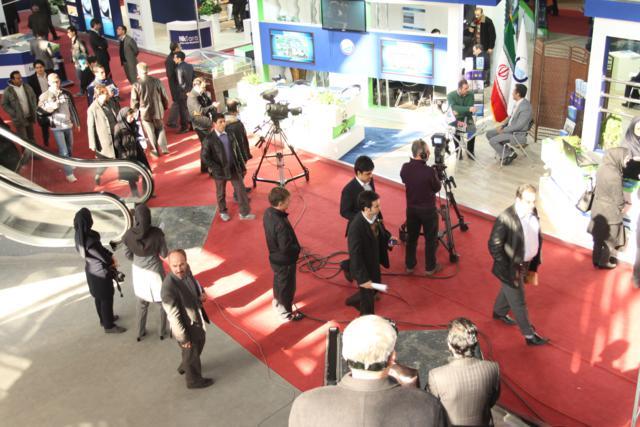

سومین نمایشگاه بین المللی صنعت سیمان در اصفهان با رویکرد بازار، صادرات و محیط زیست

به گزارش می متالز، در این نمایشگاه، ۵۵ شرکت داخلی و خارجی از استان های مختلف و نمایندگان خدمات و محصولات کشورهای فرانسه، سوئد، ژاپن، آلمان، ایتالیا، ترکیه، آمریکا، تایوان، استرالیا و امارات متحده عربی حضور و مشارکت دارند که در این میان نام کارخانه ها، واحدهای تولیدی، واحدهای تحقیقاتی و دانشگاهی، واحدهای تجهیزکننده کارخانجات، تأمین کنندگان ماشین آلات و همچنین شرکت ها و واحدهای صنعتی و اقتصادی معتبری به چشم می خورد.

این مجموعه ها طی چهار روز رقابت نمایشگاهی و در فضایی به وسعت ۳۵۰۰ مترمربع و در دو سالن نمایشگاهی، نوین ترین صنایع، ماشین آلات و تجهیزات صنعت سیمان را ارایه و در معرض دید متخصصان قرار می دهند.

برگزاری چهار کارگاه تخصصی با موضوع معرفی سیستم جدید “سرامیک روتاری فیدر”، بررسی علل خرابی بیرینگ ها در صنایع، معرفی کلی تجهیزات تولیدی کمپانی Testing آلمان و همایش نکات فنی و اجرایی بتن ریزی، فهرست برنامه های جانبی این نمایشگاه را تشکیل می دهد.

ارایه راهکارهای کاهش آلایندگی هوا در کارخانه های تولید سیمان، حفظ محیط زیست، اشتغالزایی، افزایش صادرات، افزایش راندمان تولید داخلی، آشنایی شرکت های ایرانی با آخرین تکنولوژی های روز دنیا در صنعت سیمان و بتن و ایجاد زمینه تبادل اطلاعات و تجربیات بین متخصصان و تولیدکنندگان سیمان و بتن، مهمترین اهداف برگزاری سومین نمایشگاه بینالمللی سیمان اصفهان است.

پیش بینی می شود در روزهای برگزاری این نمایشگاه چند هیأت تجاری و بازرگانی از کشورهای همسایه از نمایشگاه بازدید کرده و با تولید کنندگان سیمان کشور وارد مذاکره شوند.

این نمایشگاه هر روز از ساعت ۱۶ تا ۲۲ در محل نمایشگاه های بین المللی اصفهان واقع در پل شهرستان آماده بازدید علاقمندان است.

تحقق شعار سال ۱۴۰۳، نیازمند ایجاد شرکتهای پروژهمحور است

دستورالعمل تنظیم بازار ورق گرم فولادی بازبینی میشود

اطلاعیه فرابورس برای واگذاری استقلال و پرسپولیس

مجلس بر اجرای متناسبسازی حقوق بازنشستگان مطابق با برنامه اصرار دارد

مراسم معارفه مدیرعامل شرکت ملی صنایع مس ایران برگزار شد

افتتاح نخستین طرح پیشران اقتصادی با سرمایهگذاری "ومعادن"/ سرمایهگذاری ۳.۵ میلیارد دلاری "ومعادن"

قیمت جهانی طلا امروز ۱۴۰۳/۰۱/۲۹

دومین رکورد تناژ تولیدی تاریخ فولاد اکسین شکسته شد

کشف یک تن شیشه از بار ۲۰ تنی سنگ معدن تریلی توقیفی

بیانیه فولاد خوزستان در محکومیت دور جدید تحریمهای آمریکا علیه این شرکت/ فعالیت خود را با اقتدار و اثربخشی بیش از پیش ادامه میدهیم

فاصله بین قیمت جهانی و بهای واقعی فولاد تولیدی به جیب دولت میرود

نوسانات ارز همه ابعاد اقتصادی زندگی مردم را تحت تاثیر قرار میدهد/ دولت جدی ورود کند

نابسامانی بازار خودرو ناشی از بیتوجهی دولت به واردات است

رهبران اروپا اقتصاد را نابود کردند

طرح اصلاح جریان مالی صنعت برق وارد مرحله اجرایی شد

اوپک میتواند مانع ۱۰۰ دلاری شدن قیمت نفت شود

قیمت جهانی طلا امروز ۱۴۰۳/۰۱/۳۱

سقوط قیمت بیتکوین تا زیر ۶۰ هزار دلار

اطلاعیه جدید بانک مرکزی درباره تخصیص ارز

افتتاح بزرگترین کارخانه فروسیلیس ایران در دامغان طی سفر دولت سیزدهم

ثبت بالاترین میزان تاریخ تولید فولاد ایران در سال ۱۴۰۲

کشف یک تن شیشه از بار ۲۰ تنی سنگ معدن تریلی توقیفی

تحقق شعار سال ۱۴۰۳، نیازمند ایجاد شرکتهای پروژهمحور است

دستورالعمل تنظیم بازار ورق گرم فولادی بازبینی میشود

دومین رکورد تناژ تولیدی تاریخ فولاد اکسین شکسته شد

اطلاعیه جدید بانک مرکزی درباره تخصیص ارز

چاپ ایران چک ۵۰۰ هزار تومانی تکذیب شد

حمایت ۲.۵۵۰ همتی صندوق تثبیت بازار سرمایه از بازار سهام در فروردین ۱۴۰۳