رکوردشکنی طلا پس از ۵ سال!

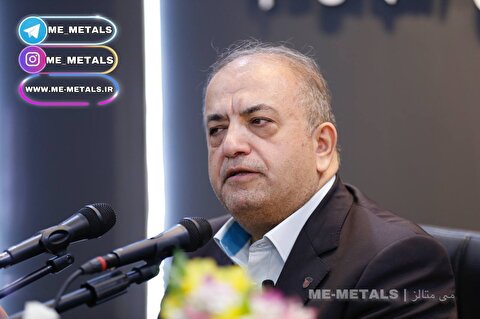

به گزارش می متالز، محمد کشتی آرای درباره دلایل گرانی سکه و طلا طی روزهای اخیر و همچنین افزایش قیمتها در بازار امروز گفت: در دو - سه روز گذشته اتفاق عجیبی که افتاده این است که طوفانی در آمریکا اتفاق افتاده است که باعث شده خیلی ازمسائل اقتصادی تحت تاثیر قرار بگیرند.

وی افزود: این طوفان آن قدر در اقتصاد منطقه آمریکا اثر گذاشته است که ارزش دلار تضعیف شده است و از طرفی چون این طوفان در تگزاس اتفاق افتاده باعث شده خیلی از شاخصهای ارزش سهام در آن منطقه به شدت کاهش پیدا کند.

رئیس اتحادیه طلا و جواهر ادامه داد: از طرف دیگر هم بالا رفتن ارزش یورو در مقابل دلار باعث شده است که ارزش دلار کاهش پیدا کند و در نتیجه قیمت طلا با توجه به کاهش ارزش دلار بالا رفته است و به بیش از ۱۳۲۲ دلار رسیده است.

کشتی آرای عنوان کرد: از سوی دیگر نیز تاثیرش در بازار داخلی این بوده که همین افزایش قیمت جهانی سبب شد که قیمت طلا و سکه رشد زیادی پیدا کند؛ به طوری که قیمت هر گرم طلای ۱۸ عیار بعد از پنج سال به بالاترین رقم یعنی بیش از ۱۲۰ هزار تومان رسیده است که این رکورد جدیدی است.

وی همچنین درباره افزایش ۱۱ هزار تومانی قیمت نیم سکه گفت: در مواقعی که چنین اتفاقی می افتد ممکن است بعضی قطعات سکه تقاضای بیشتری پیدا کند و بعضی قطعات تقاضای کمتری داشته باشد. به طور طبیعی قطعاتی که تقاضا برایش بیشتر میشود با افزایش قیمت روبرو میشوند. در مجموع با توجه به اتفاقاتی که افتاده اگر قرار است تغییری حاصل شود دو - سه روزی طول خواهد کشید تا سمت و سوی قیمت طلا مشخص شود.

پروژههای تجلی در مسیر پیشرفت/ عملیات اجرایی احداث کارخانه ۱۳۰ هزار تنی کنسانتره مس جانجا کلید خورد

آخرین مهلت رسیدگی به درخواستهای ایفای تعهدات ارزی سال ۱۴۰۱ اعلام شد

فراخوان شناسایی متقاضیان همکاری با فولاد مبارکه منتشر شد

اتمام آنومالی شمالی معدن چادرملو تا پایان سال ۱۴۰۴/ برای معادن T۱ و T۲ نیازمند روش استخراج زیرزمینی هستیم

«سیاوش عبدی» مشاور مدیرعامل، مدیر گروه روابط عمومی و حوزه مدیرعامل شد

نخستین رویداد "چادرو" به کار خود پایان داد

اولین جلسه مدیریت شرکت با حضور مدیرعامل جدید گروه ملی

نوچاد، سکوی سرمایهگذاری برای کسبوکارهای نوپا و فناورانه

نوک پیکان صادرات کشور را به سمت خدمات مهندسی سوق بدهیم

آلومینای ایران ظرفیت ویژه و منحصر به فرد در ارتقای اقتصادی و تولیدی کشور

کارگروه ستاد تسهیل و رفع موانع تولید استان مرکزی با حضور وزیر صمت برگزار شد

تدوین بسته پیشنهادی مشوقهای صنعتی و معدنی ۱۴ گانه خانه صمت ایران

برگزاری انتخابات اتحادیههای صنفی در موعد مقرر/ مشکلات یک مجتمع صنعتی بررسی شد

ایجاد منطقه ویژه اقتصادی با هدف توسعه اقتصادی و پشتیبانی تولید

سرامیکهای "کسرا" ۲۰ درصد گران شد

بیتکوین به بالای ۶۸ هزار دلار صعود کرد

رشد بازار سنگ آهن پس از تعطیلات چین

رشد قیمت بیلت در بازار چین

اعطای تسهیلات ۵۰۰ میلیون تومانی به کسبوکارهای فعال در سکوهای داخلی

پس از اصلاح ساختار مالی، بهدنبال اصلاح ساختار تولید هستیم

«سیداحمدرضا صدر» سرپرست روابط عمومی سازمان توسعه و نوسازی معادن و صنایع معدنی ایران (ایمیدرو) شد

گزارش تصویری از بازدید اصحاب رسانه از معدن و واحد دیسپچینگ مجتمع معدنی چادرملو

اختتامیه نخستین رویداد چادرو - گزارش تصویری (۲)

اختتامیه نخستین رویداد چادرو - گزارش تصویری (۱)

جیانپیترو بندتی، کارآفرین ۸۱ ساله درگذشت

برقراری تجارت آزاد بین ایران و اوراسیا تا ۲ ماه آینده

آخرین وضعیت مس جانجا به روایت مدیرعامل «تجلی»

صادرات ۱.۳ میلیون تنی فولاد خوزستان در سال گذشته