قیمت آلومینیوم، بهطور غیر مستقیم بر قیمت آلومینا تأثیرگذار است

به گزارش می متالز، آلومینا بهعنوان محصول پالایش شده بوکسیت در صنعت آلومینیوم همواره سهم قابل توجه بین 35 تا 38 درصدی در هزینههای تولید آلومینیوم اولیه داشته است. آلومینا که حالتی از اکسید خالص آلومینیوم است، طی روش مشهور بایر از سنگ معدنی بوکسیت استحصال میشود. این محصول برای استفاده در واحدهای ذوب آلومینیوم که به گرید متالورژیکی شهرت دارد، علاوه بر سنگ معدنی بوکسیت، از طریق پالایش و فرآوری سنگهای معدنی دیگری نظیر نفلین سینیت و آلونیت نیز تولید میشود؛ گرچه حجم تولید آلومینا از این دست از سنگهای معدنی در قیاس با بوکسیت در سطح بسیار پایین و قابل اغماضی است.

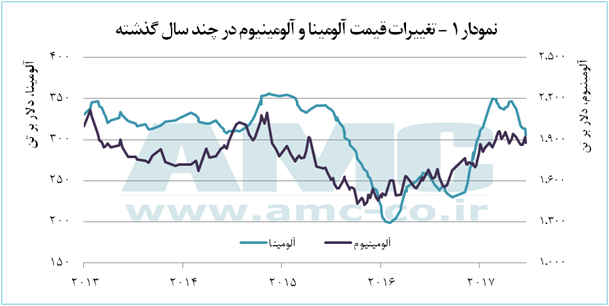

با توجه به اهمیت و سهم قابل توجه آلومینا در هزینههای کل تولید هر تن آلومینیوم اولیه، میتوان به وابستگی و ارتباط قیمت این 2 محصول به یکدیگر اذعان کرد. نمودار 1، روند تغییر قیمت آلومینیوم در بازار بورس فلزات لندن، بهعنوان بازار مرجعی در قیمتگذاری آلومینیوم و قیمت آلومینا براساس اندیس پلاتس (Platts Alumina Index) را از ابتدای سال 2013 نشان میدهد.

همانطور که در نمودار قابل مشاهده است، قیمت آلومینا و آلومینیوم روندی تقریبا مشابه را طی کردهاند؛ گرچه تغییر قیمت آلومینا با کمی تأخیر نسبت به تغییر قیمت آلومینیوم بوده است. این مقدار از تأخیر در برخی از برههها به حدود 4 یا 5 ماه میرسد، در حالی که در مواقعی عکسالعمل قیمت آلومینا نسبت به قیمت آلومینیوم کمتر از یک ماه نیز بوده است. مشابه با قیمت آلومینیوم، که در اواخر سال 2015 به کمترین مقدار خود در دوره مورد بررسی رسید، قیمت آلومینا نیز با افت شدیدی مواجه شد. ولی پس از آن با رشد آهسته قیمت آلومینیوم، قیمت هر تن آلومینا نیز روند صعودی را در پیش گرفت و همزمان با افزایش قیمت آلومینیوم به سطوح ماکزیمم خود از سال 2013، قیمت آلومینا نیز به بیشینه مقدار خود در این دوره بازگشت.

بازار آلومینا، یک بازار نقدی محسوب میشود، به این معنی که ارزش این محصول در بازار با تغییر مقدار عرضه و تقاضا تغییر کرده و وابستگی شدیدی به این امر دارد. از اصلیترین دلایل تأخیر در تبعیت قیمت آلومینا از قیمت آلومینیوم را میتوان در مقدار وابستگی عرضه و تقاضای آن با قیمت آلومینیوم جست و جو کرد. همواره افزایش قیمت آلومینیوم در بازار، تولیدکنندگان این فلز را بر آن داشته تا با افزایش تولید و سهم خود از بازار، بتوانند درآمد بیشتری را کسب کنند. این امر منجر به بالا رفتن مقدار تقاضای آلومینا و به تبع آن قیمت آن میشود. به همین ترتیب، نیز در برههای که قیمت آلومینیوم افت پیدا میکند، تولیدکنندگان با کاهش تولید و عرضه آن در بازار تلاش میکنند تا قیمت آن را در بازار افزایش دهند؛ همین امر نیز متعاقبا کاهش تقاضای آلومینا و بالطبع کاهش قیمت آن را بهدنبال خواهد داشت.

البته باید توجه داشت که بازار آلومینا تنها وابسته به قیمت آلومینیوم نیست و در واقع وابستگی غیر مستقیمی با این امر دارد. از سایر مواردی که بر قیمت آلومینا تأثیر میگذارد میتوان بهعنوان نمونه به مقدار تولید جهانی بوکسیت، واردات بوکسیت چین و صادرات آلومینیوم چین اشاره کرد.

طلای جهانی از تکاپو افتاد

بازار طلای جهانی اندکی سرد شد

ارزش سهام شرکت فولاد اقلید ۴ برابر شد

صنعت فولاد ایران هدف جدیدترین تحریمهای آمریکا

ساخت ابر پروژه فولاد استان همدان با ۳۰ هزار میلیارد ریال سرمایهگذاری

جزئیات پیشرفت پروژه عظیم مجتمع مس جانجا اعلام شد

«تجلی» همچنان بر مدار توسعه/ آخرین خبرها از اولین شرکت پروژهمحور بورس

انعقاد قرارداد همکاری مشترک هلدینگ تجلی با دانشگاه شهید بهشتی

تعدیل نیرو در کارخانه فروآلیاژ ازنا ناشی از افزایش تعرفه برق است

پورمختار: مراکز پژوهشی، راهکارهای عملی برای مشارکت مردم در جهش تولید ارائه کنند

افتتاح همزمان ۱۶ نیروگاه خورشیدی در ۶ استان کشور

ضرورت روزآمدسازی دانش و اطلاعات مدیران مناطق نفتخیز جنوب

مدیر شرایط اضطراری و بحران پتروشیمیهای منطقه ویژه پارس منصوب شد

کنترل و پایش خطوط تولید با نرمافزارهای بومی مبتنی بر هوش مصنوعی

خوشبینی پاکستان درباره تکمیل خط لوله گاز با ایران بهرغم هشدار آمریکا

باید ساختمانهای باشکوه در ایران ساخته شود

بهبود پایداری شبکه برق فوق توزیع منطقه دشت آزادگان

فروش اطلس، کوییک، شاهین، سهند و ساینا به قیمت کارخانه

شعار امسال با انسجام جامعه کارگری محقق خواهد شد

«تجلی» همچنان بر مدار توسعه/ آخرین خبرها از اولین شرکت پروژهمحور بورس

وزیر صمت: شورای رقابت مسوول قیمت پژوپارس است

افزایش قابل توجه صادرات مواد معدنی ترکیه پس از اقدامات انجمن صادرکنندگان مواد معدنی دریای اژه

شتابدهندههای قیمت طلای جهانی کداماند؟/ اثر عوامل سیاسی و اقتصادی بر رشد فلز زرد

طلای جهانی از تکاپو افتاد

جزئیات پیشرفت پروژه عظیم مجتمع مس جانجا اعلام شد

افتتاح نخستین طرح پیشران اقتصادی کشور با سرمایهگذاری «ومعادن»

ضرورت جذب سرمایهگذاری مالی و مشارکت مردمی برای توسعه معادن

پورمختار: مراکز پژوهشی، راهکارهای عملی برای مشارکت مردم در جهش تولید ارائه کنند