ایالات متحده، تصمیمگیری برای دامپینگ لولههای فولادی را به تعویق انداخت

به گزارش می متالز، در چند سال اخیر اجرای اقدامات ضد دامپینگ در حوزه صنعت فولاد خصوصا از سوی ایالات متحده، بهشدت مورد توجه قرار گرفته است. این کشور بهعنوان بزرگترین واردکننده این محصولات در سالهای اخیر و با هدف حمایت از تولیدکنندگان داخلی این آمریکا، چنین تمهیداتی را اندیشیده و در سال جاری در خصوص واردات لوله فولادی و دامپینگ از سوی برخی کشورها همچون چین، شکایتهایی را مطرح کرده است. شکایت آنتی دامپینگ ابتدا توسط 5 شرکت آمریکایی و در تاریخ 19 آوریل سال جاری ثبت شد. این واحدها عبارتند از: تولیدکننده لوله آرسلورمیتال، لوله بدون درز میشیگان، شرکت الاینس پی.تی.سی (PTC Alliance Corp)، شرکت وبکو (Webco) و همچنین صنایع زکلمن (Zekelman). پس از آن در تاریخ 10 ماه مِی، تحقیقات در خصوص این پرونده آغاز شد. در ابتدا مقرر شده بود که تا تاریخ 26 سپتامبر، در ارتباط با کشورهایی که برخی مصنوعات فولادی را با قیمتهای کمتر در بازار ایالات متحده به فروش میرسانند تصمیمگیری انجام شود، اما اتخاذ آن تا 15 نوامبر به تعویق افتاد.

وزارت بازرگانی ایالات متحده در اعلامیهای اظهار کرد که تصمیمگیری در خصوص واردات لوله فولادی به این کشور از سوی چین، آلمان، هند، ایتالیا، کره جنوبی و سوئیس همچنان ادامه دارد. تعویق یاد شده بنا به درخواست وزارت بازرگانی ایالات متحده انجام گرفته است؛ چرا که هنوز اطلاعات کافی برای جمعبندی و تصمیمگیری فراهم نشدهاند. البته پ پرسشنامهای در اختیار تولیدکنندگان خارجی قرار گرفته است که تجزیه و تحلیل درست و دقیق پرسشنامهها به زمان بیشتری نیاز دارد. بنابراین تصمیم نهایی در خصوص اقدامات ضد دامپینگ ابتدا به صورت مقدماتی منتشر میشود و در نهایت پس از 75 روز، تصمیم نهایی منتشر خواهد شد.

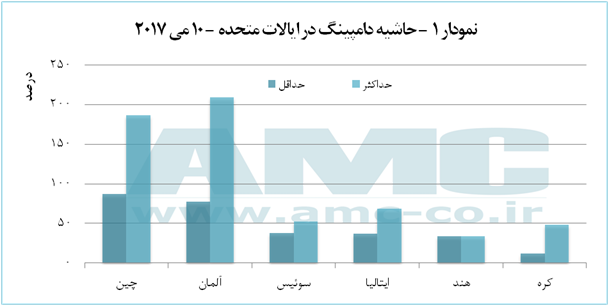

نمودار 1 میزان حاشیه دامپینگ لوله فولادی را در ایالات متحده آمریکا برای تاریخ 10 ماه مِی 2017 نشان میدهد. همانطور که در نمودار پیداست، حاشیه دامپینگ برای چین، بین 87.58 و 186.89 درصد برآورد شده است. این حاشیه دامپینگ برای آلمان نیز در محدوده 77.70 و 209.06 درصد ذکر شده است. پس از چین و آلمان، کمینه درصد حاشیه دامپینگ لوله فولادی سوئیس، با 38.02 درصد، دارای بیشترین مقدار است. مقدار حداکثر برآورد شده برای این کشور حدود 52.21 درصد ذکر شد. این رقم همچنین برای ایتالیا در محدوده 37.08 تا 68.95 درصد اعلام شد. درصد حاشیه دامپینگ تولیدکنندگان لوله فولادی هند از فروش در بازار ایالات متحده 33.80 درصد و برای تولیدکنندگان کره جنوبی نیز بین 12 تا 48 درصد گزارش شد.

افتتاح نخستین طرح پیشران اقتصادی با سرمایهگذاری "ومعادن"/ سرمایهگذاری ۳.۵ میلیارد دلاری "ومعادن"

اطلاعیه فرابورس برای واگذاری استقلال و پرسپولیس

قیمت جهانی طلا امروز ۱۴۰۳/۰۱/۲۹

بازار طلای جهانی اندکی سرد شد

کشف یک تن شیشه از بار ۲۰ تنی سنگ معدن تریلی توقیفی

افتتاح بزرگترین کارخانه فروسیلیس ایران در دامغان طی سفر دولت سیزدهم

«فصبا» ۷۰ تومان سود تقسیم کرد

درج شرکت آلیاژ گستر هامون در بازار دوم فرابورس ایران

صبا فولاد خلیج فارس «فصبا» ۷۰ تومان سود تقسیم کرد/ پروژه احیای مستقیم «فصبا» سال ۱۴۰۵ به بهرهبرداری میرسد

رکوردی دیگر در حوزه بیتکوین

کمتر از نیم درصد مردم مشمول قانون مالیات بر سوداگری میشوند

ابراز امیدواری وزیر نفت برای آغاز صادرات گاز به پاکستان

سقف برداشت از حسابهای بانکی کاهش یافت؟

مقدمات اعزام قطار ترانزیتی افغانستان به ترکیه انجام شد

قیمت نفت به بیش از ۸۷ دلار بازگشت

پیشبینی اکثر تحلیلگران از قیمت طلا و سکه کاهشی است

افت هزار واحدی شاخص کل بورس

مدیریت صحیح بانک مرکزی در شرایط فعلی/ احتمال اصلاح نرخ دلار

اجرای طرح پاداش مدیریت مصرف برق گستردهتر از ۲ سال گذشته

وزیر صمت: شورای رقابت مسوول قیمت پژوپارس است

افتتاح نخستین طرح پیشران اقتصادی کشور با سرمایهگذاری «ومعادن»

ضرورت جذب سرمایهگذاری مالی و مشارکت مردمی برای توسعه معادن

افتتاح بزرگترین کارخانه فروسیلیس ایران در دامغان طی سفر دولت سیزدهم

ثبت بالاترین میزان تاریخ تولید فولاد ایران در سال ۱۴۰۲

کشف یک تن شیشه از بار ۲۰ تنی سنگ معدن تریلی توقیفی

رکوردی دیگر در حوزه بیتکوین

فولاد هرمزگان بر مدار رکوردشکنی/ دومین رکورد تولید روزانه تختال به دست آمد

«حسن عمیدی» به عنوان سرپرست دفتر رسانه وزارت صمت منصوب شد