تقاضای فزاینده فولاد چین، سبب کاهش عیار سنگ آهن مصرفی شد

به گزارش می متالز، سنگ آهن منبع تولید آهن و ماده اولیه تولید یکی از مهمترین مواد صنعتی (فولاد) محسوب میشود. این سنگ معدنی در مراحل مختلفی که طی میکند تا به محصول قابل استفاده در فولادسازی تبدیل شود، بسته به محتوای آهن و میزان عملیات انجام شده بر روی آن، اسامی مختلفی دارد. سنگ آهن معدنی خام (Crude Ore) به سنگ استخراج شده از معدن سنگ آهن اطلاق میشود که هیچ فرآیندی بر روی آن انجام نگرفته است و به کنسانتره نیز تبدیل نشده است. درصد آهن موجود در سنگ آهن معدنی خام از 10 درصد در معادن کمعیار تا بیش از 60 درصد در معادن پرعیار متفاوت است. سنگ آهن قابل استفاده (Usable Ore) به سنگ آهنی گفته میشود که بتواند بهصورت مستقیم وارد فرآیند بهبود عیار شود و معمولا شامل 58 تا 65 درصد آهن هستند. از جمله محصولات مهمی که تحت عنوان «قابل استفاده» از آنها یاد میشود، میتوان به کنسانتره آهن و گندله اشاره کرد. بهطور معمول سنگ آهنی در صنعت قابل استفاده محسوب میشود که عیاری بالاتر از 58 درصد داشته باشد. سنگ آهنی که قابل استفاده نباشد، باید تحت فرآیندهایی قرار گیرد تا درصد آهن آن افزایش یابد. تقریبا 98 درصد تولیدات سنگ آهن قابل استفاده در صنعت، در کوره بلند برای ساخت آهن خام (Pig Iron) استفاده میشود که بعدتر برای تولید فولاد از آن استفاده میشود.

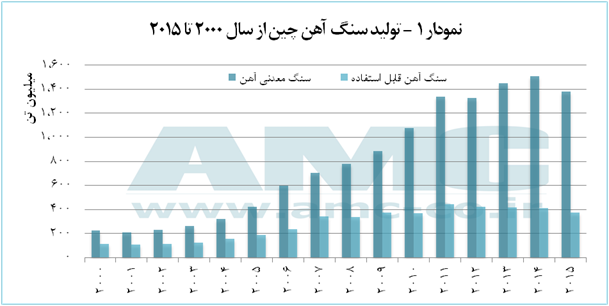

طبق دادههای سازمان زمینشناسی ایالات متحده آمریکا (USGS) کشور صنعتی چین که از سال 2000 تا 2002، تنها 12 درصد سنگ آهن جهان را تولید میکرده است. از 2003 وارد روند افزایشی شد و در 2013 با 263 درصد افزایش تولید نسبت به سال 2002 میزان تولیدش از 115 به 417 میلیون تن رسید و تولید سنگ آهن خام نیز با 522 درصد افزایش از 253 میلیون تن به 1.45 میلیارد تن رسید. اختلاف بسیار زیاد درصدهای رشد تولید سنگ آهن معدنی خام و سنگ آهن قابل استفاده، نشاندهنده کاهش عیار سنگ آهن مصرفی این کشور است که به سبب تقاضای فزاینده چین فرآوری سنگ آهنهای کمعیار نیز صرفه اقتصادی پیداکرد.

افزایش تقاضای فولاد چین سبب شد که معدنکاران خردهپا که دارای ذخایری با عیار پایینتر بودند، وارد بازار تولید شوند. به این ترتیب چین به دلیل سرعت بیسابقه رشد اقتصادی و نیاز شدید این کشور به فولاد به سطح جدیدی از تولید و مصرف سنگ آهن دست یافت.. سهم چین از تولید جهانی آهن خام طی سالهای 2000 تا 2014 از 23 درصد به 60 درصد و سهم فولاد خام این کشور در همین بازه زمانی، از 15 درصد به 50 درصد رسید!. در سالهای اخیر، چین علاوه بر تولید داخلی، بر واردات از کشورهای بزرگ تولیدکننده سنگ آهن نظیر استرالیا و برزیل نیز برای تأمین نیاز ماده اولیه تولید فولاد خود تکیه کرده است. مقایسه واردات سنگ آهن به چین طی بازه زمانی 15 ساله بین سالهای 2000 تا 2015، افزایش بیش از 13 برابری را نشان میدهد. بهطوری که در سال 2015، صادرات کشورهای استرالیا و برزیل، به ترتیب 60 و 20 درصد حجم واردات سنگ آهن چین را تشکیل داد.

افتتاح نخستین طرح پیشران اقتصادی با سرمایهگذاری "ومعادن"/ سرمایهگذاری ۳.۵ میلیارد دلاری "ومعادن"

افتتاح بزرگترین کارخانه فروسیلیس ایران در دامغان طی سفر دولت سیزدهم

طلای جهانی از تکاپو افتاد

بازار طلای جهانی اندکی سرد شد

درج شرکت آلیاژ گستر هامون در بازار دوم فرابورس ایران

تغییرات مدیریتی با تمرکز بر اهداف فنی و توسعهای/ فسادستیزی اساس کار در ایمیدرو است

ارزش سهام شرکت فولاد اقلید ۴ برابر شد

صنعت فولاد ایران هدف جدیدترین تحریمهای آمریکا

ساخت ابر پروژه فولاد استان همدان با ۳۰ هزار میلیارد ریال سرمایهگذاری

اقتصاد آلمان شگفتی آفرید

ضرر ۳۵۵ میلیون دلاری بوئینگ

شیائومی نیامده رکورد زد!

مسیر طلای جهانی عوض میشود؟

ارز روسیه پیشتاز شد

بازدید مدیرعامل و اعضای هیات مدیره «سالکو» از سایت دریایی پارسیان

عید واقعی تجلی در سال ۱۴۰۳ اتفاق خواهد افتاد

اعزام هزار و ۵۰۰ زائر در سه روز اول عملیات حج عمره

همکاریهای ایران و پاکستان در حوزه انرژی با قوت ادامه مییابد

جمعآوری مشعلهای گازی مجتمعهای پتروشیمی

«تجلی» همچنان بر مدار توسعه/ آخرین خبرها از اولین شرکت پروژهمحور بورس

وزیر صمت: شورای رقابت مسوول قیمت پژوپارس است

افزایش قابل توجه صادرات مواد معدنی ترکیه پس از اقدامات انجمن صادرکنندگان مواد معدنی دریای اژه

شتابدهندههای قیمت طلای جهانی کداماند؟/ اثر عوامل سیاسی و اقتصادی بر رشد فلز زرد

طلای جهانی از تکاپو افتاد

جزئیات پیشرفت پروژه عظیم مجتمع مس جانجا اعلام شد

افتتاح نخستین طرح پیشران اقتصادی کشور با سرمایهگذاری «ومعادن»

ضرورت جذب سرمایهگذاری مالی و مشارکت مردمی برای توسعه معادن

همراهی بانکها در تامین مالی پروژهها و طرحهای توسعه شرکت مس