«تِک» میزان تولید روی معدن رِدداگ را افزایش داد

به گزارش می متالز، قیمت هر تن فلز روی در بازار بورس لندن در ماه آگوست و سپتامبر از مرز 3 هزار دلار عبور کرد؛ با در نظر داشتن این رشد قیمتی، میتوان گفت که قیمت هر تن فلز روی نسبت به 10 سال گذشته 35 درصد افزایش داشته است. همین افزایش قیمت سبب شد بسیاری از ذخایری که تا قبل از این برداشت از آنها اقتصادی نبود، صرفه اقتصادی پیدا کنند. از جمله این موارد میتوان به 50 هزار تن از ذخایر روی آلاسکا اشاره کرد که با افزایش ارزش ذخیره معدنی آن، به تازگی عملیات معدنکاری از آن اقتصادی شده است.

معدن رِدداگ متعلق به شرکت تِک بوده و میزان تولید روی این معدن برای سال 2017 حدود 475 تا 500 هزار تن برنامهریزی شده بود. اما پیشبینی میشود که میزان تولید تا پایان سال به بین 525 تا 550 هزار تن برسد. علت این افزایش سطح تولید، بهبود بازیافت متالورژی، امکان تولید خوراک با کیفیت بالا و رسیدن به رگههای سنگ معدن با عیار بالا در نیمه دوم سال 2017 بیان شده است. بنابراین اظهارات رسیدن به این سطح تولید تا پایان سال از این معدن بعید بهنظر نمیرسد.

بنابراین در سالهای آینده ذخایر این معدن از طرفی به عمق رفته و از طرف دیگر عیار معدن کاهش مییابد و برداشت از این معدن را با مشکلاتی مواجه میکند. البته میزان تولید سالانه روی این شرکت تا سال 2020 ، در رنج بین 475 تا 550 هزار تن روی در سال خواهد ماند. در حال حاضر تِک مشغول انجام پروژهای با هزینه 110 میلیون دلار در منطقه معدنی ردداگ با هدف افزایش تولید از این معدن است. با به نتیجه رسیدن این پروژه، میزان تولید این معدن از سال 2020، حدود 15 درصد افزایش خواهد یافت و پایان عمر معدن نیز سال 2031 خواهد بود.

شرکت تِک که فعال در زمینه تولید مواد معدنی (خصوصا مس و روی)، انرژی و زغالسنگ است در سال 2016 سومین تولیدکننده بزرگ معدنی روی و یکی از بزرگترین تولیدکنندگان شمش سرب و روی تصفیه شده در دنیا بود. معادن روی تحت بهرهبرداری این شرکت عبارتند از: رِدداگ (Red Dog) واقع در آلاسکا و معدن پند اریل (Pend Oreille) واقع در واشنگتن. همچنین این شرکت دارای 25 درصد سهم معدن آنتامینا (Antamina) در پرو نیز بوده که این معدن دارای ذخایر مس و روی است.

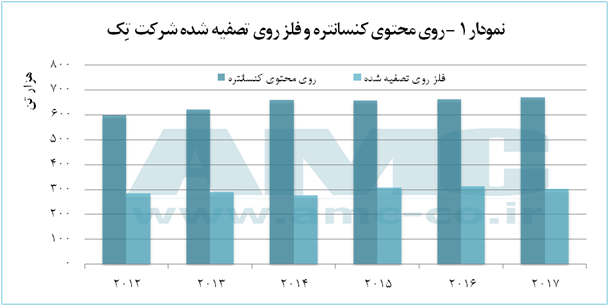

در نمودار 1 میزان تولید فلز روی تصفیه شده و روی محتوی کنسانتره تولیدی این شرکت از سال 2012 تا 2016 و پیشبینی تولید این شرکت در سال 2017 آورده شده است بهطوری که میزان تولید معدنی و تولید فلز روی تصفیه شده این شرکت طی این سالها روند صعودی را طی کرده است.

فلز کمیابی که خواب را از چشم بایدن گرفته است

تحقق شعار سال ۱۴۰۳، نیازمند ایجاد شرکتهای پروژهمحور است

بازدید فرماندار و مسوولین اجرایی شهرستان سقز از روند اجرای پروژه ملی احداث کارخانه استحصال طلای سقز

افزایش ۹ درصدی تولید سالانه در منطقه ویژه اقتصادی خلیج فارس

مجلس بر اجرای متناسبسازی حقوق بازنشستگان مطابق با برنامه اصرار دارد

ثبت سه محدوده معدنی جدید توسط شرکت اکتشاف و حفاری صدرتامین

عملکرد بیسابقه فولاد آلیاژی ایران در سال ۱۴۰۲

مراسم معارفه مدیرعامل شرکت ملی صنایع مس ایران برگزار شد

آگهی فراخوان عمومی "طرح افزایش ایمنی و بهینهسازی تابلوهای موجود MV سایت کارخانه احیاء مستقیم شرکت جهان فولاد سیرجان" - شماره مناقصه: ۱۷-۰۳-ک-م

درخواست آیتالله علمالهدی برای نظارت جدی بر وضعیت معادن

دیدار مدیرعامل و مدیران شرکت آلومینای ایران با مسوولان ارشد خراسان شمالی

اظهارنامه پیش فرض؛ گامی تازه در جهت هوشمندسازی نظام مالیاتی

واردات ۸۰۰ میلیون دلاری قطعات موتورسیکلت با رشد ۴۰ درصدی

نامه عشقی به پورابراهیمی/ تبصره ۶ بودجه ۱۴۰۳ به ضرر بورس است

کاهش درآمدهای مالیاتی به میزان ۸۵ همت در بخش دوم بودجه ۱۴۰۳

بازبینی سازمان ملل در پیشبینی رشد اقتصادی جهان

آخرین تغیرات قیمت رمزارزها در جهان

۳۸۶ هزار تن محصول در بورس کالا معامله شد

بهبود تولید سنگ آهن غول معدنی برزیل

تحقق شعار سال ۱۴۰۳، نیازمند ایجاد شرکتهای پروژهمحور است

دومین رکورد تناژ تولیدی تاریخ فولاد اکسین شکسته شد

قیمت جهانی طلا امروز ۱۴۰۳/۰۱/۲۴

پیام مدیرعامل شرکت فولاد آلیاژی ایران به مناسبت عید سعید فطر

آگهی فراخوان عمومی "طرح افزایش ایمنی و بهینهسازی تابلوهای موجود MV سایت کارخانه احیاء مستقیم شرکت جهان فولاد سیرجان" - شماره مناقصه: ۱۷-۰۳-ک-م

عملکرد بیسابقه فولاد آلیاژی ایران در سال ۱۴۰۲

مشکلی برای تأمین ارز نخواهیم داشت

افزایش ۹ درصدی تولید سالانه در منطقه ویژه اقتصادی خلیج فارس

قیمت جدید پژوپارس اعلام شد