قیمت سرب برخلاف انتظار همچنان در حال رشد است

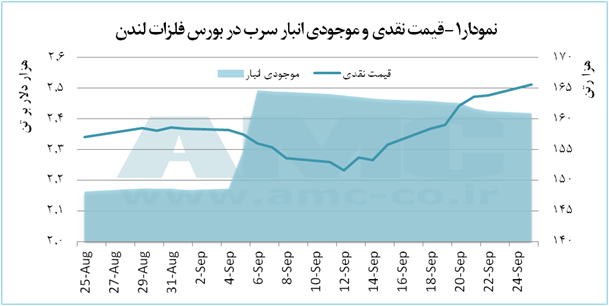

به گزارش می متالز، در نمودار 1 موجودی فلز سرب انبارهای بورس لندن و قیمت فروش نقدی آن آورده شده است. همانطور که در این نمودار مشاهده میشود، میزان موجودی سرب انبارهای بورس فلزات لندن در ماه سپتامبر نسبت به آگوست رشد داشت، اما با این وجود از هفته دوم این ماه قیمت این فلز روند رو به رشد سریعی را طی کرد و در 25 سپتامبر به 2 هزار و 500 دلار به ازای هر تن رسید.

همانطور که در نمودار نیز پیداست، در ابتدای هفته گذشته، 18 سپتامبر موجودی سرب انبارهای بورس فلزات لندن معادل 162 هزار و 900 تن و قیمت معامله نقدی آن نیز 2 هزار و 369 دلار بهازای هر تن بود. موجودی انبارها طی یک هفته گذشته روند کاهشی داشت و در 25 سپتامبر با 1.2 درصد کاهش به 160 هزار و 925 تن رسید. قیمت سرب نیز در همین زمان با 6 درصد رشد به 2 هزار و 500 دلار بهازای هر تن رسید.

از مهمترین اتفاقات مؤثر هفته گذشته که بر نرخ بهره آمریکا اثرگذار بود، برگزاری جلسه فدرال رزرو آمریکا و تأثیر آن بر شاخص ارزش دلار آمریکا بود. در این نشست 11 نفر از 16 عضو فدرال رزرو با افزایش مجدد نرخ بهره آمریکا موافقت کردند. و بنا شد که در ماه دسامبر مجددا نرخ بهره افزایش یابد. با برگزاری این جلسه شاخص ارزش دلار آمریکا افزایش یافت و در پی آن نرخ یورو که قبل از جلسه 1.2 دلار بود به زیر 1.188 دلار افت کرد. افزایش شاخص ارزش دلار آمریکا انتظار کاهش قیمت کامودیتیها را فراهم کرد.

پس از کاهش نرخ یورو، آمار PMI آلمان و اتحادیه اروپا منتشر شد که بسیار قدرتمندتر از ماه قبل و پیشبینی آن بود که همین امر موجب افزایش ارزش یورو در روزهای بعد و عبور از 1.2 دلار و موجب کاهش 0.17 درصدی شاخص ارزش دلار شد. کاهش شاخص ارزش دلار آمریکا موجب تقویت بازار کامودیتیها و افزایش قیمت فلز سرب شد.

از دیگر اتفاقات جدید روزهای اخیر که بر قیمت کامودیتیها تأثیرگذار بود، افزایش تهدیدهای امریکا به هدف قرار دادن هواپیماهای کره شمالی بود که موجب افزایش قیمت کامودیتیها شد. از طرفی هم قیمت نفت در بازارهای آمریکا به بیشترین سطح خود در 5 ماه گذشته رسید، که علت آن اعلام اوپک مبنی بر کاهش تولید و عرضه نفت و تهدید اردوغان رئیس جمهور ترکیه بر توقف صادرات نفت کردستان عراق بهعلت برگزاری رفراندوم استقلال بود. از آنجایی که قیمت نفت در ماههای اخیر سرعتگیر قیمت کامودیتیها بود، این افزایش قیمت زمینه افزایش قیمت فلزات را فراهم کرد.

طلای جهانی از تکاپو افتاد

بازار طلای جهانی اندکی سرد شد

ارزش سهام شرکت فولاد اقلید ۴ برابر شد

صنعت فولاد ایران هدف جدیدترین تحریمهای آمریکا

ساخت ابر پروژه فولاد استان همدان با ۳۰ هزار میلیارد ریال سرمایهگذاری

جزئیات پیشرفت پروژه عظیم مجتمع مس جانجا اعلام شد

«تجلی» همچنان بر مدار توسعه/ آخرین خبرها از اولین شرکت پروژهمحور بورس

عید واقعی تجلی در سال ۱۴۰۳ اتفاق خواهد افتاد

انعقاد قرارداد همکاری مشترک هلدینگ تجلی با دانشگاه شهید بهشتی

مقرراتزدایی در نزدیکی کارآفرینها/ قانون هست اجرا خیر

تامین برق مراکز برگزاری آزمون سراسری با موفقیت انجام شد

بانکها حق تعطیل کردن بنگاهها را ندارند/ ۱.۲ میلیون نفر بیمه شدند

مشعلهای گازی واحدهای پتروشیمی جمعآوری میشوند

افزایش ۶ برابری مصرف برق با استفاده از کولر گازی در مناطق معتدل

انجام ۲ پرواز به مقصد مدینه منوره

آرامکوی عربستان حامی مالی فیفا شد

کاهش قیمت بیتکوین تا ۶۳ هزار دلار

۲۶ طرح فوق توزیع و انتقال برق تا پایان اردیبهشت وارد مدار میشود

بازگشت ۳۰۰۰ واحد تعطیل به تولید/ ۱.۲ میلیون نفر بیمه شدند

«تجلی» همچنان بر مدار توسعه/ آخرین خبرها از اولین شرکت پروژهمحور بورس

وزیر صمت: شورای رقابت مسوول قیمت پژوپارس است

افزایش قابل توجه صادرات مواد معدنی ترکیه پس از اقدامات انجمن صادرکنندگان مواد معدنی دریای اژه

شتابدهندههای قیمت طلای جهانی کداماند؟/ اثر عوامل سیاسی و اقتصادی بر رشد فلز زرد

طلای جهانی از تکاپو افتاد

بیتکوین آماده شد

فولاد هرمزگان بر مدار رکوردشکنی/ دومین رکورد تولید روزانه تختال به دست آمد

جزئیات پیشرفت پروژه عظیم مجتمع مس جانجا اعلام شد

افتتاح نخستین طرح پیشران اقتصادی کشور با سرمایهگذاری «ومعادن»