سرویس خبر : آهن و فولاد

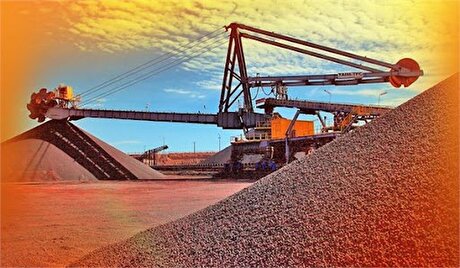

کاهش جزیی ظرفیت تولید فولاد جهانی در نیمه نخست سال

می متالز - عدم توازن ساختاری عرضه و تقاضا در بازارهای جهانی فولاد هنوز اصلاح نشده و در 6 ماه نخست سال جاری میلادی ظرفیت جهانی تولید فولاد افت جزیی داشته است.

به گزارش می متالز، ظرفیت تولید فولاد جهان پایان نیمه نخست سال 2017 از 2.3695 میلیارد تن 6 ماهه نخست 2016 به 2.3565 میلیارد تن رسیده است.

در سال جاری وضعیت بازارهای فولاد کمی بهتر شده است و نشانه هایی از بهبود در برخی از بازارها نمایان است. تولید جهانی فولاد خام نیز نیمه نخست امسال 4.35 درصد نسبت به مدت مشابه سال 2016 رشد داشته است.

طبق آمار انجمن جهانی آهن و فولاد، تولید جهانی فولاد بین ژانویه تا ژوئن 2017 به 835.67 میلیون تن رسیده است. البته روشن نیست این بهبود دوام دارد یا خیر چون میزان ظرفیت تولید و تقاضا به توازن نرسیده اند. چالش هایی نیروی کار صنعت فولاد را تهدید می کند برخی اختلافات تجاری در بازارهای فولاد دنیا وجود دارد و نوسانات مالی نیز ادامه دارند.

منبع: ایفنا

عناوین برگزیده

چهارده ساعت پیش

پانزده ساعت پیش

هفده ساعت پیش

دو روز پیش

فلز کمیابی که خواب را از چشم بایدن گرفته است

بازدید فرماندار و مسوولین اجرایی شهرستان سقز از روند اجرای پروژه ملی احداث کارخانه استحصال طلای سقز

در گفتگو با مدیرعامل نخستین شرکت پروژهمحور در ایران عنوان شد:

تحقق شعار سال ۱۴۰۳، نیازمند ایجاد شرکتهای پروژهمحور است

صالحی:

مجلس بر اجرای متناسبسازی حقوق بازنشستگان مطابق با برنامه اصرار دارد

افزایش ۹ درصدی تولید سالانه در منطقه ویژه اقتصادی خلیج فارس

ثبت سه محدوده معدنی جدید توسط شرکت اکتشاف و حفاری صدرتامین

شرکت سرمایهگذاری توسعه معادن و فلزات

"ومعادن" با رشدی ۳۳ درصدی بهای تمام شده سرمایهگذاریهای خود به استقبال سال جدید رفت

طی ۱۱ ماهه ۱۴۰۲ صورت گرفت:

افزایش تولید ۱۶ درصدی «گندله» و ۹ درصدی «کنسانتره» سنگ آهن شرکتهای بزرگ

ثبت سومین رکورد تولید روزانه آهن اسفنجی در فولاد هرمزگان

جزئیات تسهیلات ۲۰۰ هزار میلیارد تومانی اشتغال در ۱۴۰۳

قیمت جهانی طلا امروز ۱۴۰۳/۰۱/۲۸

قیمت جهانی نفت امروز ۱۴۰۳/۰۱/۲۸ |برنت ۹۰ دلار و ۷۲ سنت شد

استفاده از پهپاد در معدنکاری چه مزیتها و چالشهایی دارد؟

کارکرد فناوریهای نو در معادن

افزایش قیمت روی با کاهش موجودی انبارها

لزوم همراهی دولت با فعالان بخش معدن

توسعه سبد محصولات برای ارتقای سهم صادراتی جهان فولاد سیرجان

معروفخانی خبر داد:

چهارمین کنفرانس بینالمللی فولادسازی و ریختهگری در فولاد هرمزگان برگزار میشود

جلسه مدیریت بحران فولاد هرمزگان برگزار شد

مدیر کارخانه کنسانتره اسدآباد خبر داد:

از برنامه انتقال پساب به کارخانه کنسانتره تا انتقال باطلهها به کورههای آجرپزی

تحقق شعار سال ۱۴۰۳، نیازمند ایجاد شرکتهای پروژهمحور است

دومین رکورد تناژ تولیدی تاریخ فولاد اکسین شکسته شد

قیمت جهانی طلا امروز ۱۴۰۳/۰۱/۲۴

آگهی فراخوان عمومی "طرح افزایش ایمنی و بهینهسازی تابلوهای موجود MV سایت کارخانه احیاء مستقیم شرکت جهان فولاد سیرجان" - شماره مناقصه: ۱۷-۰۳-ک-م

عملکرد بیسابقه فولاد آلیاژی ایران در سال ۱۴۰۲

مشکلی برای تأمین ارز نخواهیم داشت

افزایش ۹ درصدی تولید سالانه در منطقه ویژه اقتصادی خلیج فارس

ثبت رکورد برای اقتصاد چین

حراج شمش طلا پس از ۱۱ سال تعلیق در ویتنام