تعدیل منفی ۴۱ درصدی یک فولادی منجر به توقف نماد شد

به گزارش می متالز،شرکت آهن و فولاد ارفع با سرمایه 299.4 میلیارد تومانی درخصوص تغییر با اهمیت پیش بینی درآمد هر سهم اقدام به شفاف سازی کرد.

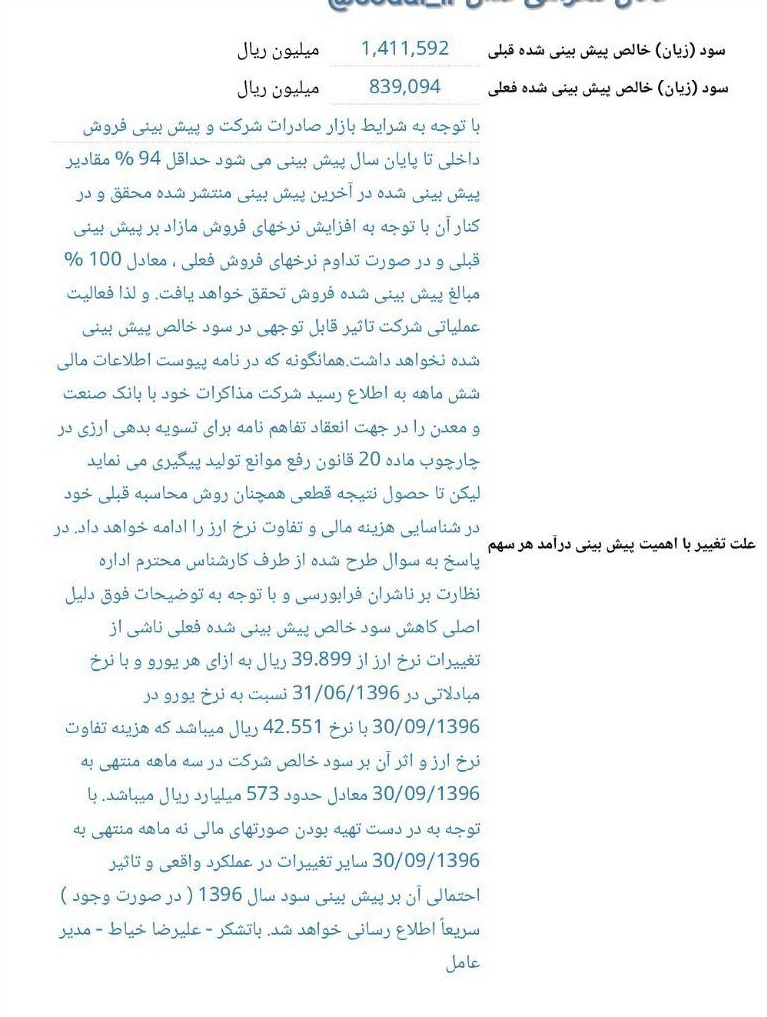

براین اساس،در پیش بینی درآمد هر سهم سال مالی 96 ، میزان سود هر سهم در گزارش قبلی "ارفع" 141.1 میلیارد تومان پیش بینی شده بود اما در گزارش جدید این سود با تعدیل منفی 41 درصدی همراه و با کاهش به 83.9 میلیارد تومان رسیده است،

از این رو،این شرکت فرابورسی پیش بینی کرد حداقل 94 درصد مقادیر در آخرین براورد محقق و در کنار آن معادل 100 درصد مبالغ پیش بینی شده فروش تحقق یابد.بنابراین فعالیت عملیاتی شرکت تاثیر قابل توجهی در سود خالص پیش بینی شده نخواهد گذاشت.

همچنین علت اصلی کاهش سود خالص پیش بینی شده ناشی از تغییرات نرخ ارز از 3989 تومان به ازای هر یورو و با نرخ مبادلاتی در انتهای شهریور ماه نسبت به نرخ یورو در آذر ماه با نرخ 4255 تومان است که هزینه تفاوت نرخ ارز و اثر آن بر سود خالص شرکت در 3 ماهه منتهی به آذر ماه معادل 57.3 میلیارد تومان است.

در این راستا،به استناد ماده 12 مکرر دستورالعمل اجرایی نحوه انجام معاملات در فرابورس اعلام شد: با توجه به ابهامات موجود در اطلاعات با اهمیت منتشر شده توسط ناشر، نماد معاملاتی حداکثر به مدت 2 روز کاری متوقف و ناشر موظف به رفع ابهامات موجود در اطلاعات با اهمیت منتشر شده است.

تحقق شعار سال ۱۴۰۳، نیازمند ایجاد شرکتهای پروژهمحور است

دستورالعمل تنظیم بازار ورق گرم فولادی بازبینی میشود

اطلاعیه فرابورس برای واگذاری استقلال و پرسپولیس

مجلس بر اجرای متناسبسازی حقوق بازنشستگان مطابق با برنامه اصرار دارد

مراسم معارفه مدیرعامل شرکت ملی صنایع مس ایران برگزار شد

افتتاح نخستین طرح پیشران اقتصادی با سرمایهگذاری "ومعادن"/ سرمایهگذاری ۳.۵ میلیارد دلاری "ومعادن"

قیمت جهانی طلا امروز ۱۴۰۳/۰۱/۲۹

کشف یک تن شیشه از بار ۲۰ تنی سنگ معدن تریلی توقیفی

دومین رکورد تناژ تولیدی تاریخ فولاد اکسین شکسته شد

فاصله بین قیمت جهانی و بهای واقعی فولاد تولیدی به جیب دولت میرود

نوسانات ارز همه ابعاد اقتصادی زندگی مردم را تحت تاثیر قرار میدهد/ دولت جدی ورود کند

نابسامانی بازار خودرو ناشی از بیتوجهی دولت به واردات است

رهبران اروپا اقتصاد را نابود کردند

طرح اصلاح جریان مالی صنعت برق وارد مرحله اجرایی شد

اوپک میتواند مانع ۱۰۰ دلاری شدن قیمت نفت شود

قیمت جهانی طلا امروز ۱۴۰۳/۰۱/۳۱

سقوط قیمت بیتکوین تا زیر ۶۰ هزار دلار

اطلاعیه جدید بانک مرکزی درباره تخصیص ارز

قیمت جهانی نفت امروز ۱۴۰۳/۰۱/۳۱| برنت ۸۹ دلار و ۴۲ سنت شد

افتتاح بزرگترین کارخانه فروسیلیس ایران در دامغان طی سفر دولت سیزدهم

ثبت بالاترین میزان تاریخ تولید فولاد ایران در سال ۱۴۰۲

کشف یک تن شیشه از بار ۲۰ تنی سنگ معدن تریلی توقیفی

تحقق شعار سال ۱۴۰۳، نیازمند ایجاد شرکتهای پروژهمحور است

دستورالعمل تنظیم بازار ورق گرم فولادی بازبینی میشود

دومین رکورد تناژ تولیدی تاریخ فولاد اکسین شکسته شد

اطلاعیه جدید بانک مرکزی درباره تخصیص ارز

چاپ ایران چک ۵۰۰ هزار تومانی تکذیب شد

حمایت ۲.۵۵۰ همتی صندوق تثبیت بازار سرمایه از بازار سهام در فروردین ۱۴۰۳