قصد خرید شرکت فولادی جدیدی را نداریم

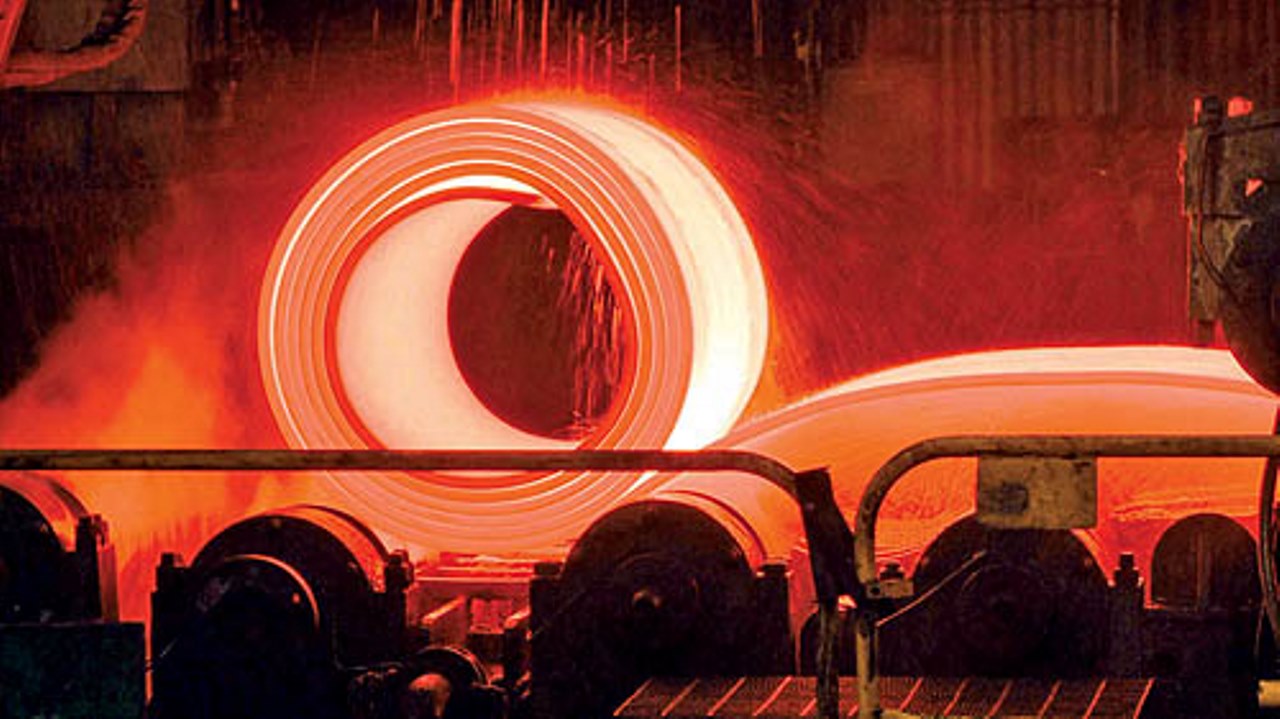

به گزارش می متالز، بهرام سبحانی با اعلام این مطلب گفت: فولاد مبارکه به دنبال خرید شرکت های فولادی دیگر نیست. فولاد مبارکه در راستای هماهنگی بین تامین کنندگان خدمات و مواد اولیه در صدد مدیریت در تکمیل زنجیره تولید با هدف تولید محصول کیفی و اقتصادی با ارزش افزوده بالاست.

وی افزود: هم اکنون از سنگان و فنس مبارکه، گندله و کنستانتره و در ادامه احیا مستقیم، نورد سرد و گرم و ریخته گری همگی تحت مدیریت واحد شرکت صورت می پذیرد که این برنامه ریزی و سیاست مهم باعث می شود شرکت فولاد مبارکه همواره سود قابل قبولی داشته باشد و در مقابل بحران های اقتصادی مقاوم تر باشد.

سبحانی ادامه داد: در راستای تکمیل زنجیره تولید در فولاد مبارکه، شرکت هایی همچون فولاد هرمزگان، سپید دشت، سبا، امیرکبیر کاشان، ورق خودرو چهارمحال، ورق تاراز، مجتمع معادن سنگان و همچنین سه هلدینگ توکا فولاد، متیل و آتیه فولاد نقش جهان اقدام به تامین خدمات فنی مهندسی، نرم افزاری و سخت افزاری می کنند. فولاد مبارکه همواره از توان متخصصین بویژه بازنشستگان خود شرکت بهرمند بوده است.

طلای جهانی از تکاپو افتاد

بازار طلای جهانی اندکی سرد شد

ارزش سهام شرکت فولاد اقلید ۴ برابر شد

صنعت فولاد ایران هدف جدیدترین تحریمهای آمریکا

ساخت ابر پروژه فولاد استان همدان با ۳۰ هزار میلیارد ریال سرمایهگذاری

جزئیات پیشرفت پروژه عظیم مجتمع مس جانجا اعلام شد

انعقاد قرارداد همکاری مشترک هلدینگ تجلی با دانشگاه شهید بهشتی

«تجلی» همچنان بر مدار توسعه/ آخرین خبرها از اولین شرکت پروژهمحور بورس

تعدیل نیرو در کارخانه فروآلیاژ ازنا ناشی از افزایش تعرفه برق است

پورمختار: مراکز پژوهشی، راهکارهای عملی برای مشارکت مردم در جهش تولید ارائه کنند

افتتاح همزمان ۱۶ نیروگاه خورشیدی در ۶ استان کشور

ضرورت روزآمدسازی دانش و اطلاعات مدیران مناطق نفتخیز جنوب

مدیر شرایط اضطراری و بحران پتروشیمیهای منطقه ویژه پارس منصوب شد

کنترل و پایش خطوط تولید با نرمافزارهای بومی مبتنی بر هوش مصنوعی

خوشبینی پاکستان درباره تکمیل خط لوله گاز با ایران بهرغم هشدار آمریکا

باید ساختمانهای باشکوه در ایران ساخته شود

بهبود پایداری شبکه برق فوق توزیع منطقه دشت آزادگان

فروش اطلس، کوییک، شاهین، سهند و ساینا به قیمت کارخانه

شعار امسال با انسجام جامعه کارگری محقق خواهد شد

«تجلی» همچنان بر مدار توسعه/ آخرین خبرها از اولین شرکت پروژهمحور بورس

وزیر صمت: شورای رقابت مسوول قیمت پژوپارس است

افزایش قابل توجه صادرات مواد معدنی ترکیه پس از اقدامات انجمن صادرکنندگان مواد معدنی دریای اژه

شتابدهندههای قیمت طلای جهانی کداماند؟/ اثر عوامل سیاسی و اقتصادی بر رشد فلز زرد

طلای جهانی از تکاپو افتاد

جزئیات پیشرفت پروژه عظیم مجتمع مس جانجا اعلام شد

افتتاح نخستین طرح پیشران اقتصادی کشور با سرمایهگذاری «ومعادن»

ضرورت جذب سرمایهگذاری مالی و مشارکت مردمی برای توسعه معادن

پورمختار: مراکز پژوهشی، راهکارهای عملی برای مشارکت مردم در جهش تولید ارائه کنند